UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

| | | | | | | | | | | | | | | | | |

| Filed by the Registrant | x | | Filed by a Party other than the Registrant | ¨ | |

| | | | | |

| Check the appropriate box: |

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

| | |

LendingClub Corporation (Name of Registrant as Specified in its Charter)

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

| | | | | | | | |

| Payment of Filing Fee (Check all boxes that apply): |

x

| No fee required. |

¨

| Fee paid previously with preliminary materials. |

¨

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

595 Market Street, Suite 200

San Francisco, California 94105

NOTICE OF 20232024 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 8, 202311, 2024

To Our Stockholders:

NOTICE IS HEREBY GIVEN that the 20232024 Annual Meeting of Stockholders of LendingClub Corporation (the “Company,” “LendingClub,” “we,” “us” and “our”) will be held on June 8, 202311, 2024 at 11:8:00 a.m. Pacific Time via the Internet at www.virtualshareholdermeeting.com/LC2023LC2024 (the “Annual Meeting”). There is no physical location for the Annual Meeting.

At the Annual Meeting, you will be asked to:

1.Elect Kathryn Reimann, Scott SanbornSyed Faiz Ahmad (Faiz Ahmad), Allan Landon and Michael ZeisserTimothy Mayopoulos as Class IIII directors, each of whom is currently serving on our Board of Directors, to serve until the 20262027 Annual Meeting of Stockholders and until his or her successor has been elected and qualified or his or her earlier death, resignation or removal;

2.Approve, on a non-binding advisory basis, the compensation of our named executive officers as disclosed in the Proxy Statement;

3.Ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023;2024;

4.Approve a management proposal to amend and restate the Company’s Restated Certificate of Incorporation to phase in the declassification of our Board of Directors;

5.Approve a management proposal to amend and restate the Company’s Restated Certificate of Incorporation to remove the supermajority voting requirements to amend our governing documents; and

6.Approve a management proposal to amend and restate the Company’s Restated Certificate of Incorporation to limit the personal liability of certain officers of the Company as permitted by Delaware law; and

7.Approve a management proposal to amend and restate the Company’s 2014 Equity IncentiveEmployee Stock Purchase Plan to extend the expiration of the 2014 Equity IncentiveEmployee Stock Purchase Plan by fourten years from December 2024 to December 2028.2034, and make certain other changes.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Only stockholders of record at the close of business on April 11, 202315, 2024 are entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof.

By Order of the Board of Directors,

Brandon PaceJordan Cheng

Chief Administrative OfficerGeneral Counsel and Corporate Secretary

San Francisco, California

April [XX], 20232024

Whether or not you expect to participate in the Annual Meeting, please vote via the Internet, by phone, or complete, date, sign and promptly return the accompanying proxy in the enclosed postage-paid envelope (if applicable) so that your shares may be represented at the Annual Meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 8, 2023:11, 2024: THIS PROXY STATEMENT, PROXY, AND THE ANNUAL REPORT ARE AVAILABLE AT WWW.PROXYVOTE.COM

Dear Stockholders,

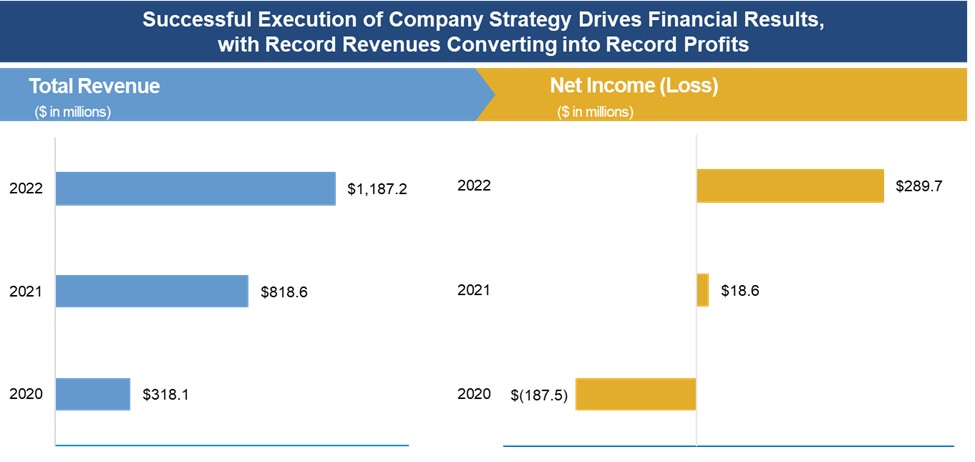

We areAs a digitally native, vertically integrated, customer-focused company, and one of a small number of fintech companies with a national bank charter, we are building a new kind of bank, one that brings together fintechaims to advantage our members with the information, tools, and bankingguidance they need to help our over 4.5 million members manageachieve their own version of financial lives.success. We do this by leveraging data and technology to improveincrease access to credit, lower borrowing costs, and improve returnsthe return on savings. As record inflationsavings – all through a smart, simple, and elevated interest rates have strained the finances of Americans across income bands even further, our purpose and opportunity have never been greater.rewarding digital experience.

Despite a challenging macroeconomic environment, we continue to develop and launch market-leading products and features. In 2022, despite2023, we sold over $1.5 billion in Structured Certificates – a new type of structured program transaction that allows investors to earn compelling levered returns without the headwinds of increasing inflationneed for the financing typically required for a whole loan purchase, while we earn an attractive yield with remote credit risk. For consumers, we’re introducing TopUpTM and interest rates,CleanSweepTM products, which give our members additional avenues for additional money and/or lower debt payments. And we delivered record revenuehave more on the roadmap, as we leverage our commitment to innovation and profitability through fee revenue from our capital-light marketplace, and durable interest income from loans held on our balance sheet. We also invested in our mobile offering to enhance our customer experience, and leveraged our banking advantage by repurchasing a $1.05 billion portfolio of high-quality LendingClub personal loans which had been previously purchased by one of our bank partners; this helped mitigate a slowdown in our marketplace fee revenue.bank model to advantage our members.

In 2023, we are positioningWe’ve been able accomplish the Companyabove while maintaining our commitment to remain profitable while navigating an increasingly challenging macro environment. We have madethroughout 2023. Given the adverse impact of the ongoing macroeconomic environment on our business, we resized our expense base. Unfortunately, that included difficult but necessary decisions to streamline our workforce. However, among other factors, our resolve on expense management andpositioned us to successfully exit our operating agreement with the Office of the Comptroller of the Currency (OCC) in early 2024. We remain keenly focused on execution,prudently operating the business, including delivering on credit quality. Although the macro environment appears likely to remain dynamic and uncertain over the near and intermediate term, we believe that LendingClub has tremendous opportunities ahead and is well placed to resume growth as conditions stabilize.

Critical to our ability to successfully operate our business and execute against future opportunities is recruiting and retaining a talented employee base. Attrition remains low and we continue to receive external accolades with respect to our workplace. And since our last annual meeting, we have made a number of critical new hires, including successfully transitioning to our new CFO, Drew LaBenne. Drew replaced Tom Casey, who recently retired after playing a critical role at LendingClub as our finance chief, director and valued leader.

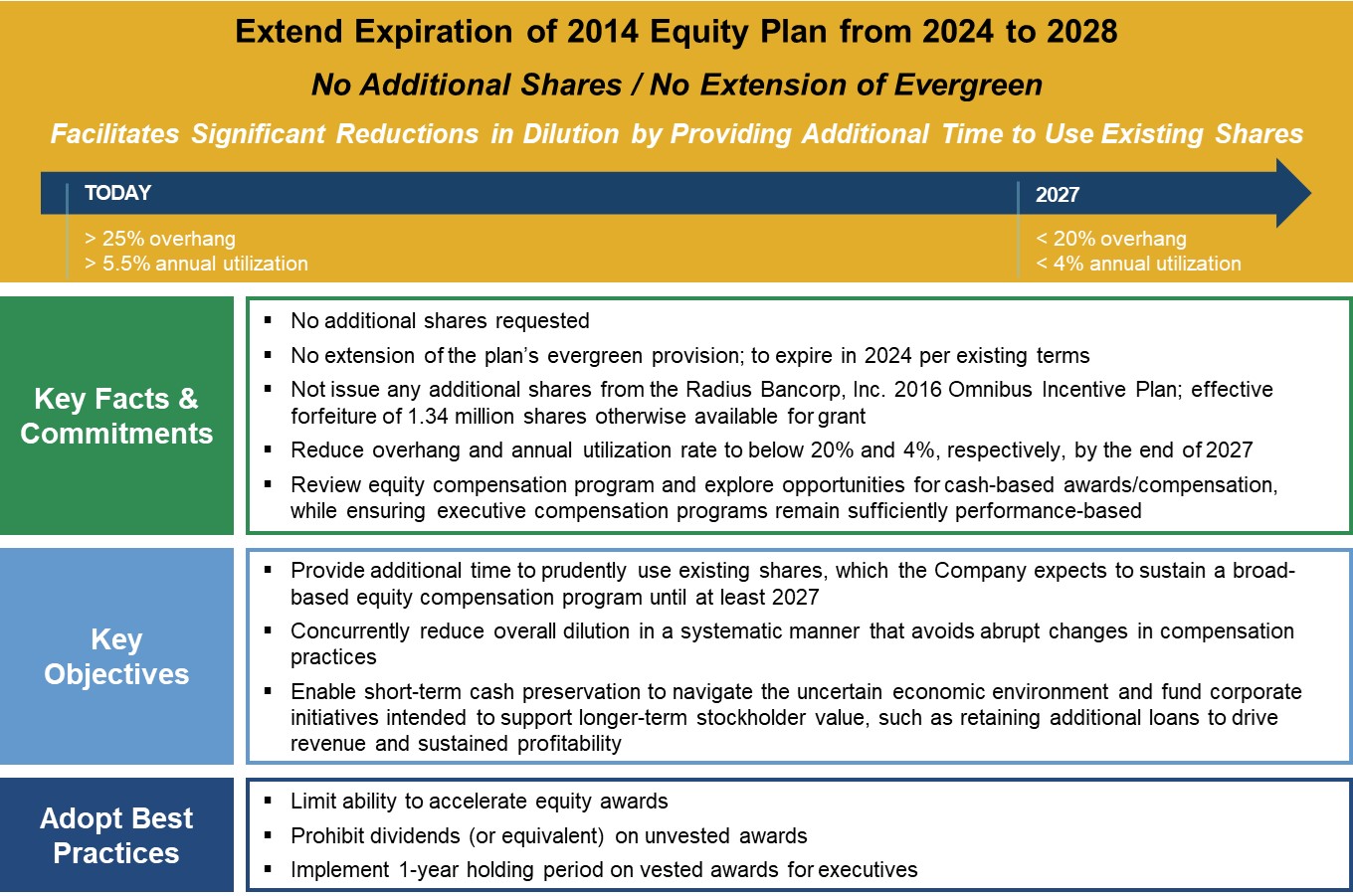

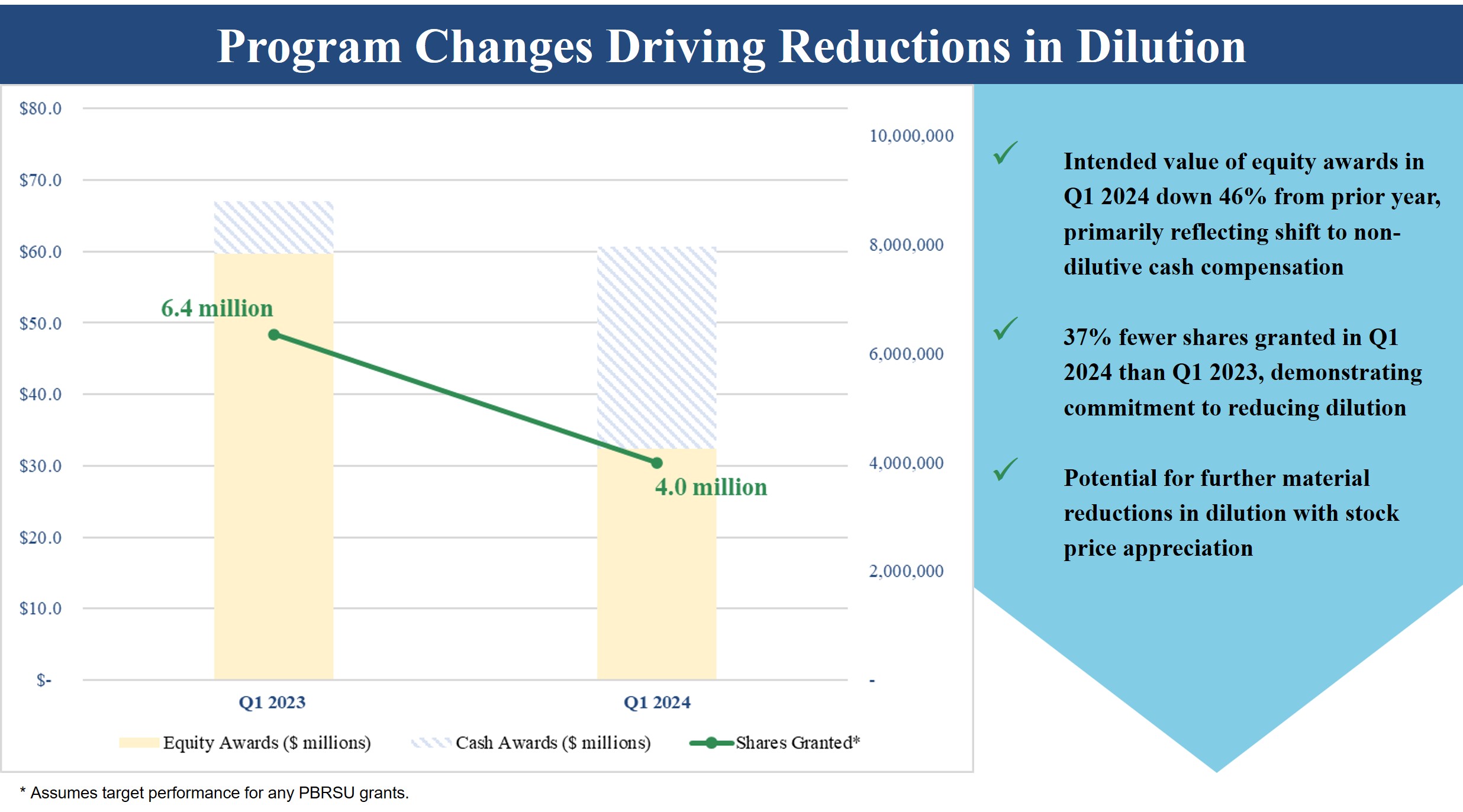

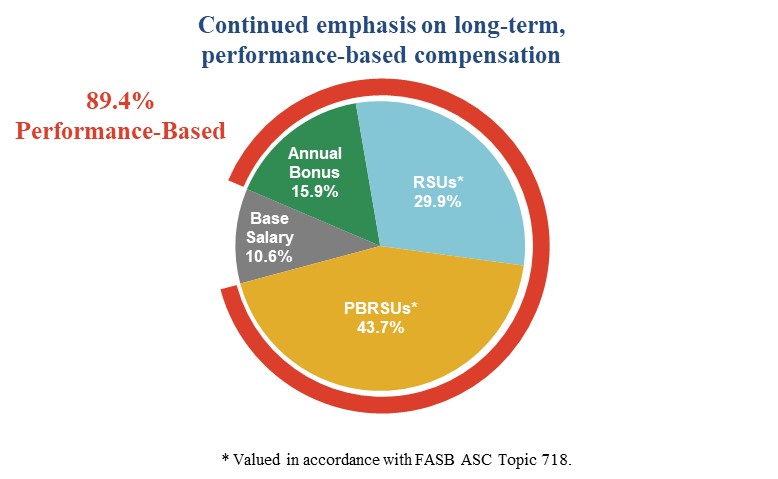

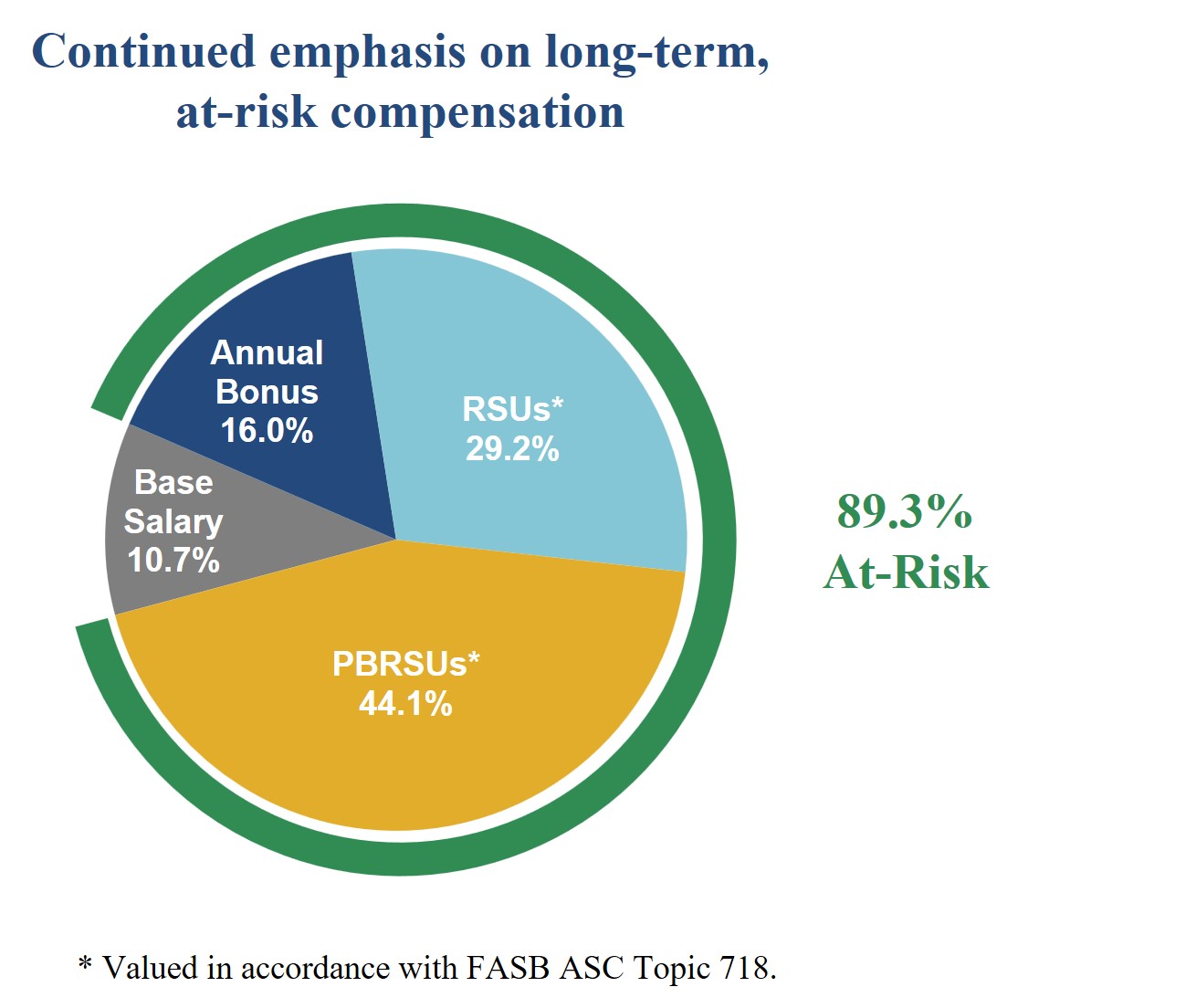

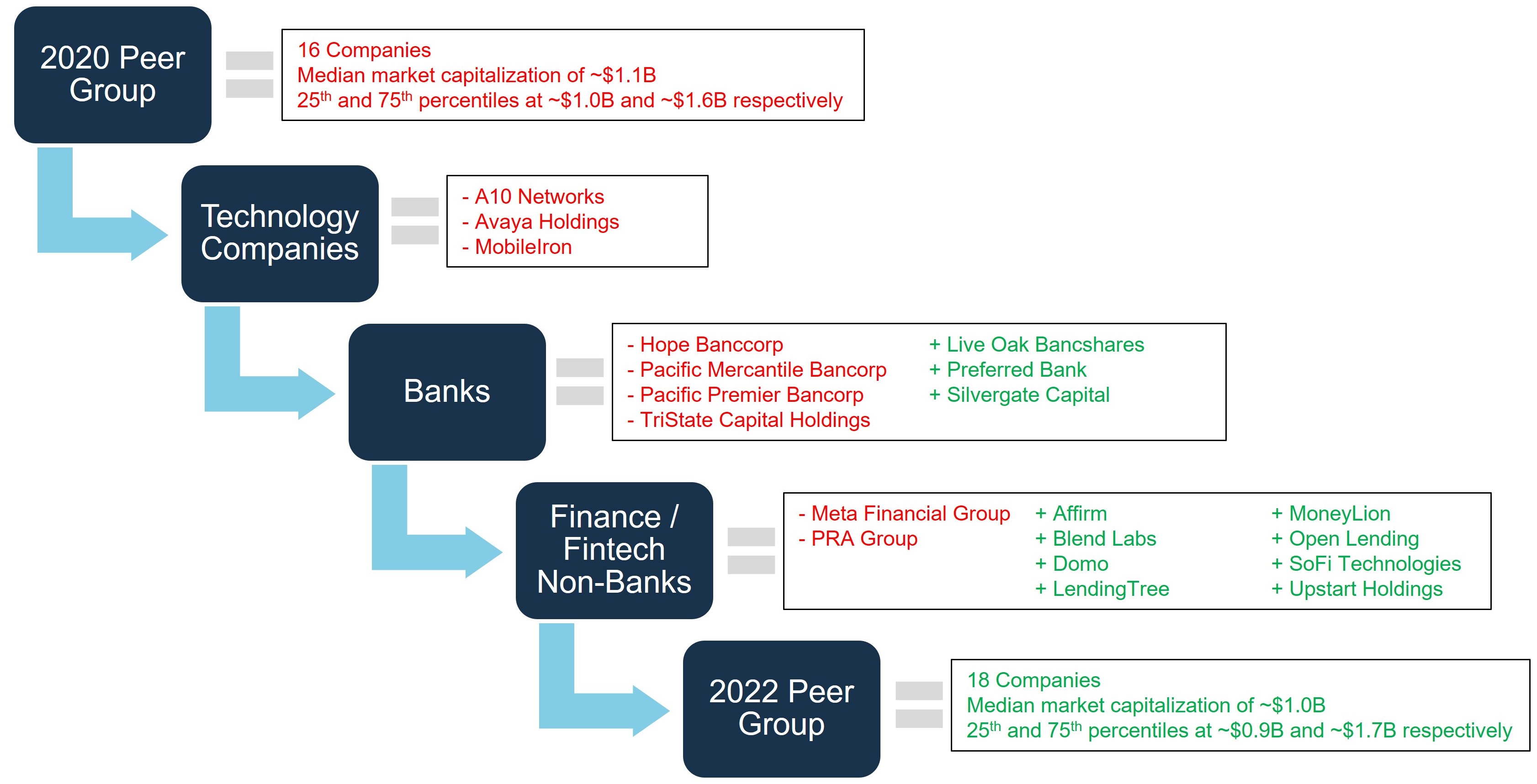

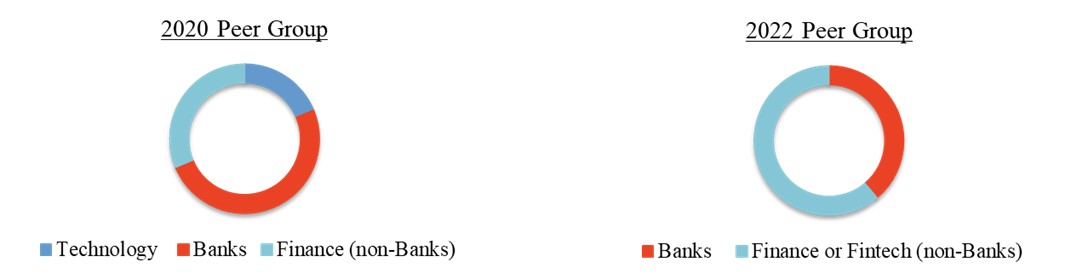

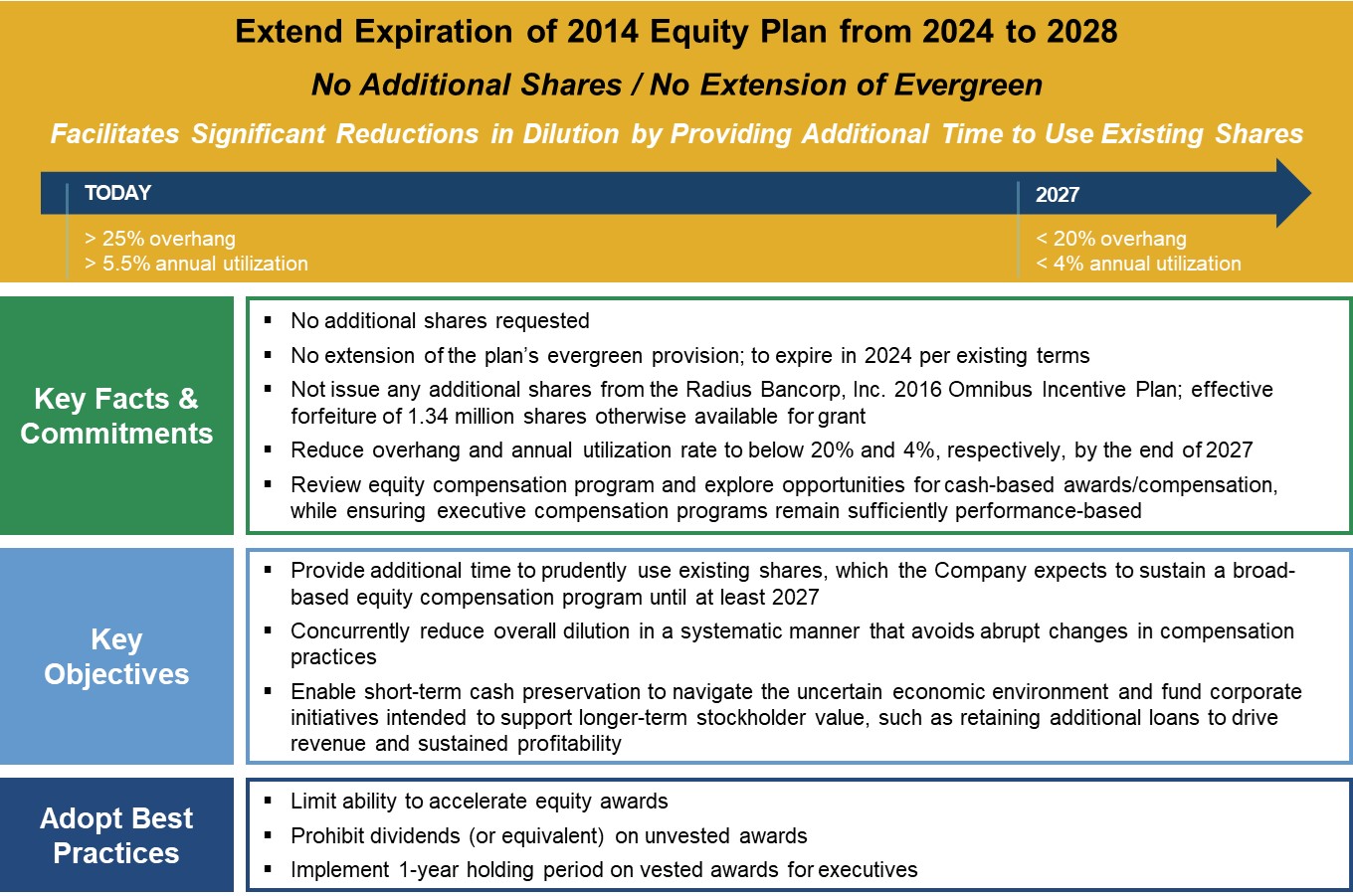

Maintaining high employee engagement and productivity necessitate that we deliver a compelling combination of culture, opportunity, and compensation. As a fintech company with a substantial presence in the San Francisco Bay Area, we operatehave historically operated a broad-based, equity oriented, long-term incentive program to deliver market compensation while driving alignment with stockholders across the organization.market-required compensation. We are cognizant of the dilution this creates on our stockholders and have undertaken a numberimplemented several changes to reduce the overhang and annual utilization rate from our equity compensation program to below 20% and 4%, respectively, by the end of mitigating2027. We engaged with many of our largest stockholders on the topic and they have been nearly universally supportive of our efforts and initiatives, including reducing award sizes, allowing employeesallocating a greater portion of target compensation to voluntarily elect cash compensation in lieu of equity and changingcompensation to reach our tax withholding mechanics to provide for holding back, rather than selling, shares in connection with the vesting of RSUs.stated dilution targets.

We are committed, however, to further reducing the dilution fromAs we reduce equity participation through our equity compensation program, andwe are evaluating the merits of resuming our Employee Stock Purchase Plan to provide employees another avenue for equity participation. Therefore, this year we have therefore included a proposal in this year’s proxy to extend the expiration of our 2014 Equity IncentiveEmployee Stock Purchase Plan, from 2024 to 2028 to reflect and facilitate our desire to spread the number of shares alreadywhich otherwise expires in the program over a longer period of time.December 2024. Please note that the proposal does not solicit any new shares, nor does it extend the existing evergreen provision, which will automatically sunset per its original terms in 2024. We are simply requesting additional time to use existing shares, while making commitments to adopt various best practices and substantially -- yet prudently -- reduce the dilution created by our equity compensation program. Accordingly, we believeearlier this proposal is a win-win as it supports the recruiting and retaining of critical talent while enabling reductions in the dilution stockholders experience from equity compensation.year. Please refer to pages 3 andpage 7068 of this proxy statement for more information on this important proposal.

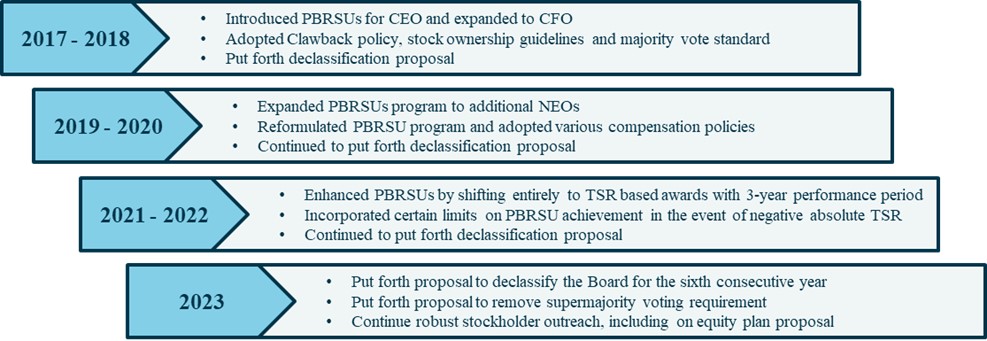

Further, we have included two important governance proposals for your consideration. First, we continue to believe in the merits of a declassified board and have again included a proposal this year to phase out our current classified board structure. Second, we have again included a proposal this year to remove the supermajority voting standard to amend our governing documents.

As part In 2023, more than 99% of our commitmentstockholders that voted supported these measures; however, we did not receive the necessary number of votes for them to good governance, inpass. These proposals, along with our efforts to reduce the months leading up todilution from equity compensation, address the filing of this proxy statement, we engaged with several stockholders on the direction of our compensation and governance programs. Among other things, we discussed the three proposals described above. Supported by these discussions, we believe these proposals addressmost common areas of stockholder feedback and thereforefeedback. Therefore, we highly encourage you to vote “FOR” each of them.these proposals.

Although the macro environment appears likely to remain dynamic and uncertain over the near and intermediate term, we believe that LendingClub has tremendous opportunities ahead and is well placed to resume growth as conditions stabilize.

With our award-winning banking product, market-leading lending capabilities, innovation-oriented culture and seasoned executive team, we remain optimistic about our future and committed to creating value for our stockholders, as well as our customers, employees and communities.

On behalf of the entire board,Board, thank you for your investment in LendingClub.

Sincerely,

Scott Sanborn, Chief Executive Officer and member of the Board

John C. (Hans) Morris, Independent Chairman of the Board

| | | | | | | | |

20232024 PROXY STATEMENT | PROXY SUMMARY |

PROXY SUMMARY

April [XX], 20232024

| | | | | | | | |

| Proposal | Board Recommendation | Page |

Proposal One: Election of Class IIII directors | For each nominee | |

| Proposal Two: Advisory vote to approve the compensation of our named executive officers | For | |

Proposal Three: Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the 20232024 fiscal year | For | |

| Proposal Four: Management proposal to amend and restate the Company’s Restated Certificate of Incorporation to phase in the declassification of the Board of Directors | For | |

| Proposal Five: Management proposal to amend and restate the Company’s Restated Certificate of Incorporation to remove the supermajority voting requirements to amend our governing documents | For | |

| Proposal Six: Management proposal to amend and restate the Company’s Restated Certificate of Incorporation to limit the personal liability of certain officers of the Company as permitted by Delaware Law | For | |

Proposal Seven: Management proposal to amend and restate the Company’s 2014 Equity IncentiveEmployee Stock Purchase Plan to extend the expiration of the 2014 Equity IncentiveEmployee Stock Purchase Plan by fourten years from December 2024 to December 20282034, and make certain other changes | For | |

The Notice of Internet Availability of Proxy Materials (the “Notice”), Proxy Statement, form of proxy and Annual Report on Form 10-K for the year ended December 31, 20222023 (the “Annual Report”) will be first distributed and made available to stockholders on or about April [XX], 2023.2024.

LendingClub Corporation (“LendingClub”(including its subsidiaries, “LendingClub”, the “Company”, “we”, “us”, “our”) operates America’sa leading digital marketplace bank.bank with innovative and market-leading products and features. As a digitally native, vertically integrated, customer-focused company, and one of a small number of fintech companies with a national bank charter, we are uniquely positionedbuilding a new kind of bank, one that aims to rewriteadvantage our members with the rulesinformation, tools, and guidance they need to achieve their own version of traditional banking and create a suite of integrated financial products and services that make smart money moves simple and rewarding.success. We do this by bringing together the best of both worlds – fintech and banking – leveraging data and technology to increase consumer access to credit, lower their borrowing costs, and improve the return on their savings while delivering– all through a seamless experience that focuses on fairnesssmart, simple, and simplicity.

The Company was founded in 2006 and brought a traditional credit product – the installment loan – into therewarding digital age by leveraging technology, data science and a unique marketplace model. In doing so, we became one of the largest providers of unsecured personal loans in the United States. In February 2021, LendingClub completed the acquisition of an award-winning digital bank, Radius Bancorp, Inc. (“Radius”), becoming a bank holding company and forming LendingClub Bank, National Association (“LendingClub Bank”), as its wholly-owned subsidiary through which we operate the vast majority of our business. The result is a combination of complementary strengths that create an economically attractive and resilient digital marketplace bank.experience.

Our customers – our “members” – can gain access to a broader range of financial products and services designed to help them digitally optimize their lending, spending and savings. Economic volatility and the current rising costs of healthcare, housing, education and more have contributed to millions of everyday Americans having insufficient financial reserves or living paycheck to paycheck, including approximately 50% of those earning over $100,000 annually. They often turn to a limited set of higher cost debt solutions to bridge cash flow gaps and manage their financial lives. Our mission is to empower our members on a path to better financial health, giving them new ways to pay less on their debt and earn more on their savings. Since 2007, more than 4.5 million individuals have become members, joining the Club to help achieve their financial goals.

Our primary loan products include unsecured personal loans, secured auto refinance loans, and patient and education finance loans. We currently offer borrowers multiple features to lower their cost of debt and enhance their financial health, including balance transfers (where a borrower’s existing credit card debt is directly paid down and the loan is consolidated into a fixed-rate term loan) and joint applications (where borrowers may receive a better rate when they jointly apply for a personal

| | | | | | | | |

LENDINGCLUB CORPORATION| 1

|

| | | | | | | | |

2023 PROXY STATEMENT | PROXY SUMMARY |

loan). These loan products are underpinned by a scalable technology platform and capabilities targeted directly at our members’ core needs to either lower the cost of their debt and/or improve the returns on their savings. Our commercial lending business is primarily focused on small businesses, and we participate in the U.S. Small Business Administration lending programs. Our deposit business includes sourcing deposits directly from consumer and commercial customers and from third-party marketing channels and deposit brokers. For consumer depositors, we offer high-yield savings accounts, checking accounts and certificates of deposit. With our FDIC-insured high-yield savings account, members can enhance their savings by earning competitive interest on their entire balance. Our checking accounts deliver an award-winning digital experience, customer friendly features, such as ATM fee rebates, no overdraft fees, and early direct deposits. Since 2007, more than 4.8 million individuals have become members, joining the Club to help achieve their financial goals.

| | | | | | | | |

LENDINGCLUB CORPORATION| 1 |

| | | | | | | | |

| 2024 PROXY STATEMENT | PROXY SUMMARY |

To execute on our vision, grow the business responsibly and create value for our stockholders, it is critical that we have a sophisticated, dedicated and committed management team, overseen by an independent Board of Directors (the “Board”) with substantial and relevant expertise.

| | |

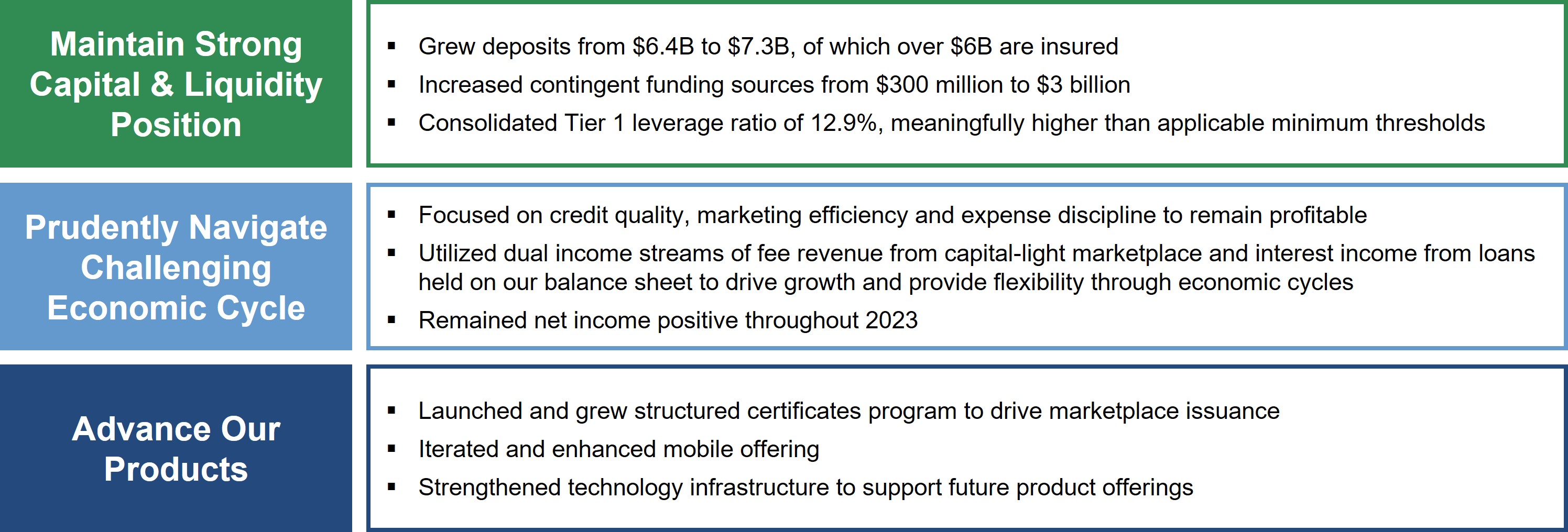

20222023 Strategic Priorities and Results |

Our management team and Board are deeply focused on the evolution, execution and oversight of our strategy. Below is a summary of key 20222023 strategic priorities and how we executed against them.

Executing against

| | |

| Responsiveness to Stockholder Feedback |

Our Board believes it is important to maintain an open dialogue with stockholders to understand their views on the Company, its strategy and its governance and compensation practices. Therefore, we engage with stockholders regularly and solicit feedback annually on our 2022 strategic priorities drove record financial resultscompensation and governance practices. Consistent with prior years, members of our management team participated in 2022.these conversations, and stockholders were also offered the opportunity to speak with a member of our Board. Stockholders have overwhelmingly expressed support for the proactive approach the Company has taken to solicit and incorporate stockholder feedback.

In early 2023 and early 2024, we reached out to stockholders representing, in aggregate, an estimated 50% and 46% of our then outstanding shares, respectively, and held meetings with those that requested a discussion, including with the governance departments of some of our largest institutional stockholders. Some stockholders declined our invitation for a discussion, citing a lack of questions or concerns. In total, since January 1, 2023 through our annual stockholder outreach, we have had conversations with stockholders holding, in aggregate, an estimated 42% of our outstanding shares. In addition to our annual stockholder outreach on governance and compensation practices, we maintain ongoing dialogue with many of our stockholders through our investor relations program.

Overall, the stockholders we engaged with expressed support for our strategy and compensation and governance practices. Among other things, stockholders inquired about the cadence of the Company’s review of its ESG disclosures and supported the Company’s commitment to incrementally evolve and enhance its ESG disclosures as rulemaking on the topic evolves and is finalized. Further, stockholders recognized that executive retention is critical over the next few years as the Company navigates the current macroeconomic environment and positions the Company to resume growth. Below is a summary of other feedback we received from our total revenuestockholders and GAAP consolidated net income/loss performance.how we’ve responded.

| | | | | | | | |

LENDINGCLUB CORPORATION | 2 |

| | | | | | | | |

20232024 PROXY STATEMENT | PROXY SUMMARY |

| | | | | |

| What We Heard | | What We Have Done |

| Equity Programs |

Responsiveness•Stockholders expressed a desire for us to Stockholder Feedbackreduce the dilution from our equity compensation program

| •Evolved compensation program to reduce equity utilization (see below) •Terminated evergreen provision in our 2014 Equity Incentive Plan, as amended and restated (the “2014 Equity Incentive Plan”), resulting in forfeiture of over 7 million shares that would otherwise be available for grant •Committed to not issue any of the remaining 1.34 million shares available for grant under the 2016 Radius incentive plan •Amended the 2014 Equity Incentive Plan to limit ability to accelerate awards |

| PBRSU Design |

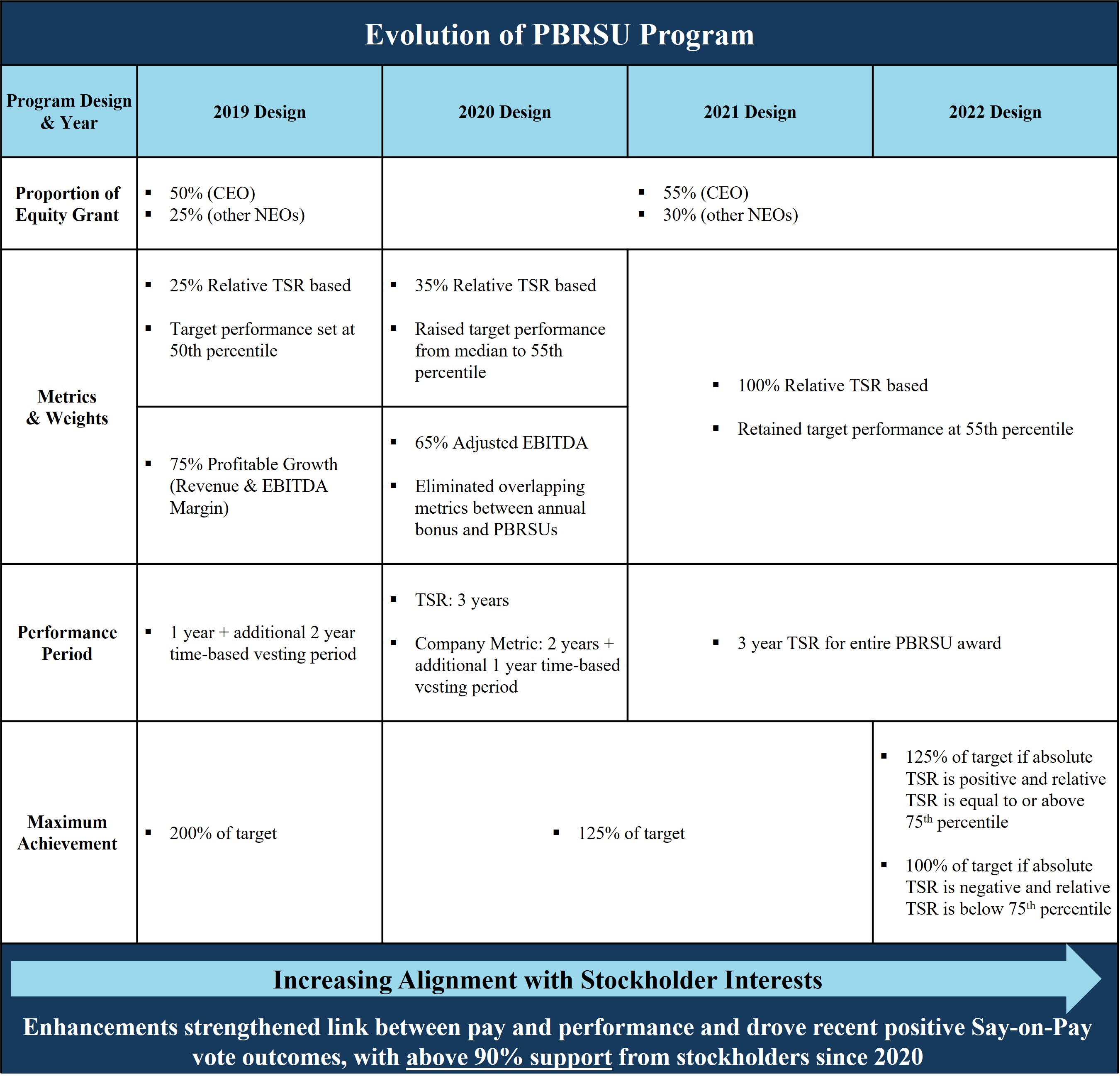

•Some stockholders expressed a desire for us to diversify our performance-based restricted stock unit (“PBRSU”) program to include an ambitious, but attainable, multi-year operating metric | •Allocated 50% of the intended value of our 2024 PBRSUs to achievement against a 3-year operating metric •Continued to allocate the remaining 50% of the intended value of our 2024 PBRSUs to achievement against a 3-year relative TSR metric, with target performance remaining at the 55th percentile |

| Corporate Governance |

•Stockholders continue to support our efforts to declassify the Board | •For the seventh consecutive year, the Board is recommending a proposal to phase-out our classified Board at this year’s Annual Meeting •Despite the support of 99% of stockholders that voted in 2023, the proposal has not yet received the requisite number of votes to pass |

•Some stockholders prefer that we eliminate the supermajority vote requirement to amend our governing documents | •For the second consecutive year, the Board is recommending a proposal to eliminate the supermajority voting requirement to amend our governing documents at this year’s Annual Meeting •Despite the support of 99% of stockholders that voted in 2023, the proposal has not yet received the requisite number of votes to pass |

•Stockholders appreciated our willingness to evolve and adopt policies to reflect feedback and heightened standards | •Implemented a 1-year holding period on vested equity awards, net of taxes, for executive officers •Adopted clawback policies with coverage greater than applicable requirements |

•Stockholders support the refreshment and composition of our Board | •Appointed two new directors in 2023 •Majority of Board appointed since 2021, with recent appointments adding diversity and significant banking experience |

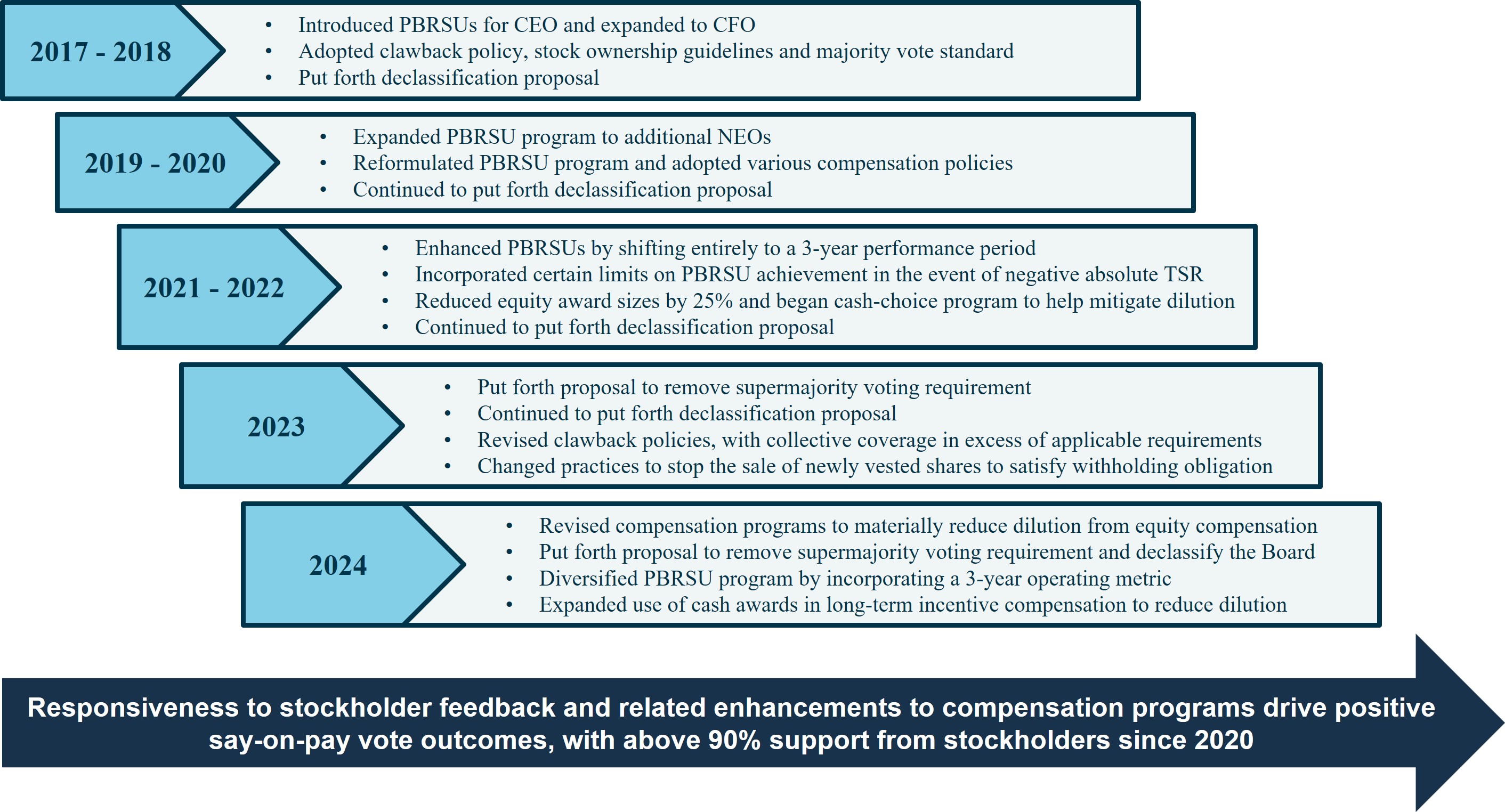

Our Board and Compensation Committee have undertaken a number of changes or measures to be responsive to feedback regarding our governance and compensation practices each year since 2017. Below is a brief summary of what we have done. Stockholders have overwhelmingly expressed support for the initiative the Company has taken to solicit and incorporate stockholder feedback.

| | |

Proposed Amendment and Restatement of 2014 Equity Incentive PlanReducing Dilution |

Our Board believes that our success depends on the ability to attract the best available personnel. Therefore, we strive to provide compensation packages that are competitive, reward personal and company performance, and enable us to recruit and retain the talent necessary to operate our business and execute against our intermediate and long-term strategic objectives. To that end, the Company operates a broad-based equity program to deliver market compensation while driving alignment with stockholders across the organization. In 2022, a total of 866 employees (over 50%) received an equity award,connection with our executive officers receiving 16.6% of the total intended value. Without an equity compensation program, we believe we would be at a significant disadvantageproposal in terms of recruiting2023 to amend and retaining talent, especially for leadership roles and relative to other fintech companies operating in the San Francisco Bay Area market.

However, we are also cognizant of the dilution created by our equity compensation program on our stockholders. Although, we have implemented a number of measures intended to mitigate the level of dilution, it remains elevated. Therefore, as part of our commitment to good and proactive governance, in January 2023 we filed a Winter 2023 stockholder outreach presentation with the Securities and Exchange Commission (the “SEC”) to, among other things, solicit feedback on a proposal to extend the expiration ofrestate our 2014 Equity Incentive Plan, (the “Plan”) by four yearswe made an accompanying commitment to December 2028. We believematerially reduce the proposaldilution created from our equity compensation program. Specifically, our stated targets are to extend the expiration of our Plan is a win-win for the Company and our stockholders by allowing the Company additional time to grant existing shares while facilitating significant reductions to dilution over time. Specifically, if our proposal to amend and restate the Plan is approved, we expect to significantly reduce equity utilization through a combination of prudent use of equity, operational changes (such as changes in withholding mechanics), higher stock price and/or steady shift towards cash-based awards/compensation. Notably, we will target reducing the overhang and annual utilization rate from our equity compensation program to below 20% and 4%, respectively, by the end of 2027.

In discussing with stockholders, we noted the substantial measures we had already taken to manage dilution, including:

•Reduced Award Sizes. Adjusted our internal guidelines to reduce target equity award sizes by 25%.

•Cliff Vesting. All equity awards to new hire employees have a one-year cliff before vesting begins.

•Cash-Choice Program. We created a “cash-choice” program where non-executive employees can elect to receive a portion of their long-term incentive award in the form of a fixed value cash award in lieu of equity.

•Stock Options. We discontinued our use of stock options for equity awards, and instead award restricted stock units (“RSUs”) and PBRSUs to our employees and executives as long-term incentive awards.

| | | | | | | | |

LENDINGCLUB CORPORATION | 3 |

| | | | | | | | |

20232024 PROXY STATEMENT | PROXY SUMMARY |

Importantly, the proposal does not request any new shares, nor does it request an extension•Tax Withholding for Equity Awards. We changed our withholding practices on employee compensation income from RSU/PBRSU vest events to hold back a portion of the previously stockholder approved evergreen provision. Below is an overviewnewly vested shares and remit cash from our treasury accounts to the tax authorities, in lieu of selling shares into the proposal.open market.

TheWe discussed, and stockholders that we engaged with generally expressed support for our proposal to amendappreciated and restate the Plan, as well as our accompanying commitment to reduce dilution and adopt various best practices. In particular, stockholders noted that the proposal was thoughtful and appreciated the Company’s transparency and self-awareness. With respect to dilution, stockholders recognized the significant steps the Company has taken to date and welcomed the commitment to significantly reduce dilution from the Company’s compensation programs over time. Further, stockholders appreciatedacknowledged, that equity compensation is a fundamental component of the Company’s ability to deliver marketcompetitive levels of compensation and that abruptly shifting to and increasing cash compensation to offset unavailability offurther reductions in equity compensation would need to be disadvantageousoffset by increases in the current economic climate and may also adversely impact the Company’s abilitycash compensation in order to attract and retain the human capital necessary to execute and advance itsthe Company’s strategy. With respect

Equity awards are denominated in dollars to employees and then converted into shares/units; typically, by dividing the timingintended target dollar value by the 30-day trailing average of the proposal, stockholders recognized thatCompany’s stock price. Consequently, an increasing stock price results in reduced dilution as fewer shares are required to cover the soonerintended target dollar value of an equity award. The Company considered the Company is provided more timemerits of not implementing any program changes and instead waiting for stock price appreciation to use its existing share reserve, the more expeditiously and systematically it can begin taking measures tonaturally reduce the dilution created from its equity compensation program. However, the Company determined that being more proactive with respect to reducing dilution, without the benefit of stock price appreciation, was preferable given the feedback the Company received from its stockholders on the importance and urgency of reducing dilution.

Finally, while some stockholders expressedAccordingly, in 2024 we adopted a preference forprogram whereby all long-term incentive awards, including those granted to executives, are bifurcated into an equity incentive plan that does not contain an evergreen provision, all stockholders we spokeportion (e.g., PBRSU and/or RSU) and a fixed value cash-based portion, with appreciated that the Company’s proposal does not include an extension offixed value cash-based portion vesting over 3-years like the evergreen provisionequity portion. This program change is intended to decrease equity utilization, while keeping target compensation levels intact and acknowledged thatproviding the Company is entitledanother multi-year retention feature in its compensation program. We believe this program was the best available solution to balance reducing dilution, rewarding and retaining employees, and managing compensation expense. For executives, compensation remains largely performance based with a majority of total target compensation in the final remaining evergreen tranche in 2024 per the original termsform of the Plan.a multi-year long-term incentive award.

Further details regardingThe Company grants long-term incentive awards quarterly, with a substantial majority of grants made in the proposed amendmentQ1 grant cycle, as the Q1 grant cycle includes annual refresh awards as compared to the Q2 through Q4 grant cycles which typically consist entirely of new-hire awards. The below graphic depicts the number of shares underlying long-term incentive awards granted in Q1 of 2023 and restatement2024, illustrating the impact of program changes on our 2014 Equity Incentive Plan can be found in Proposal Sixuse of this Proxy Statement, beginning on page 70.equity.

| | | | | | | | |

LENDINGCLUB CORPORATION | 4 |

| | | | | | | | |

20232024 PROXY STATEMENT | PROXY SUMMARY |

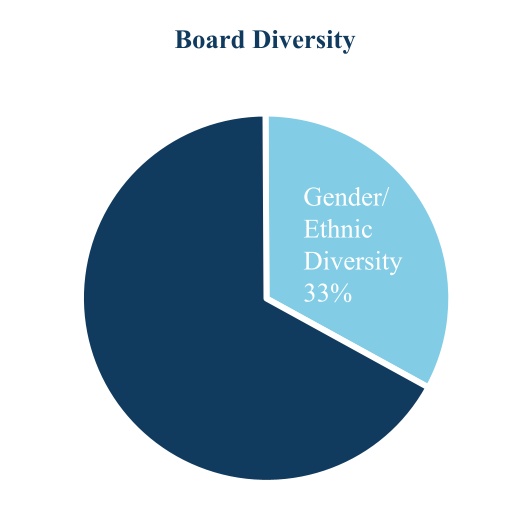

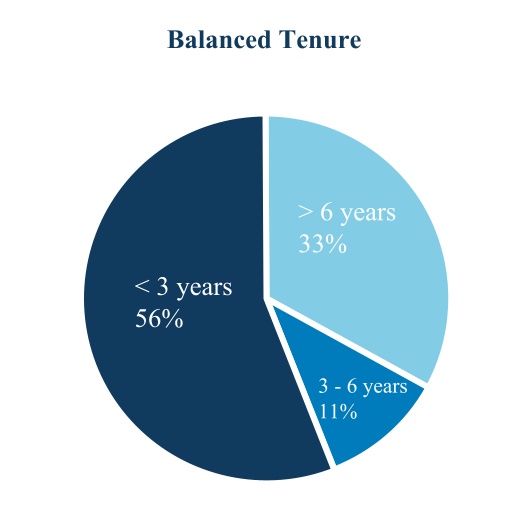

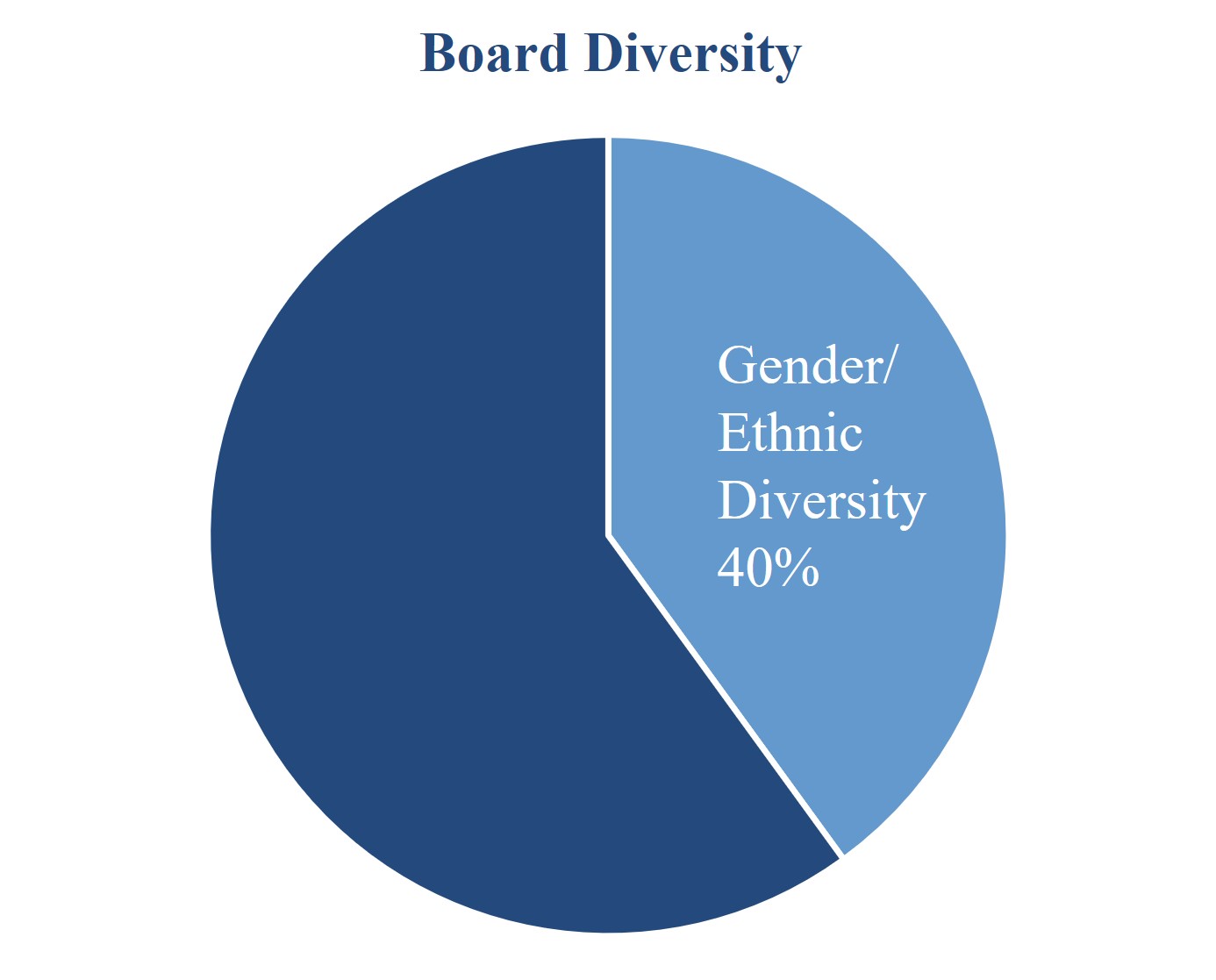

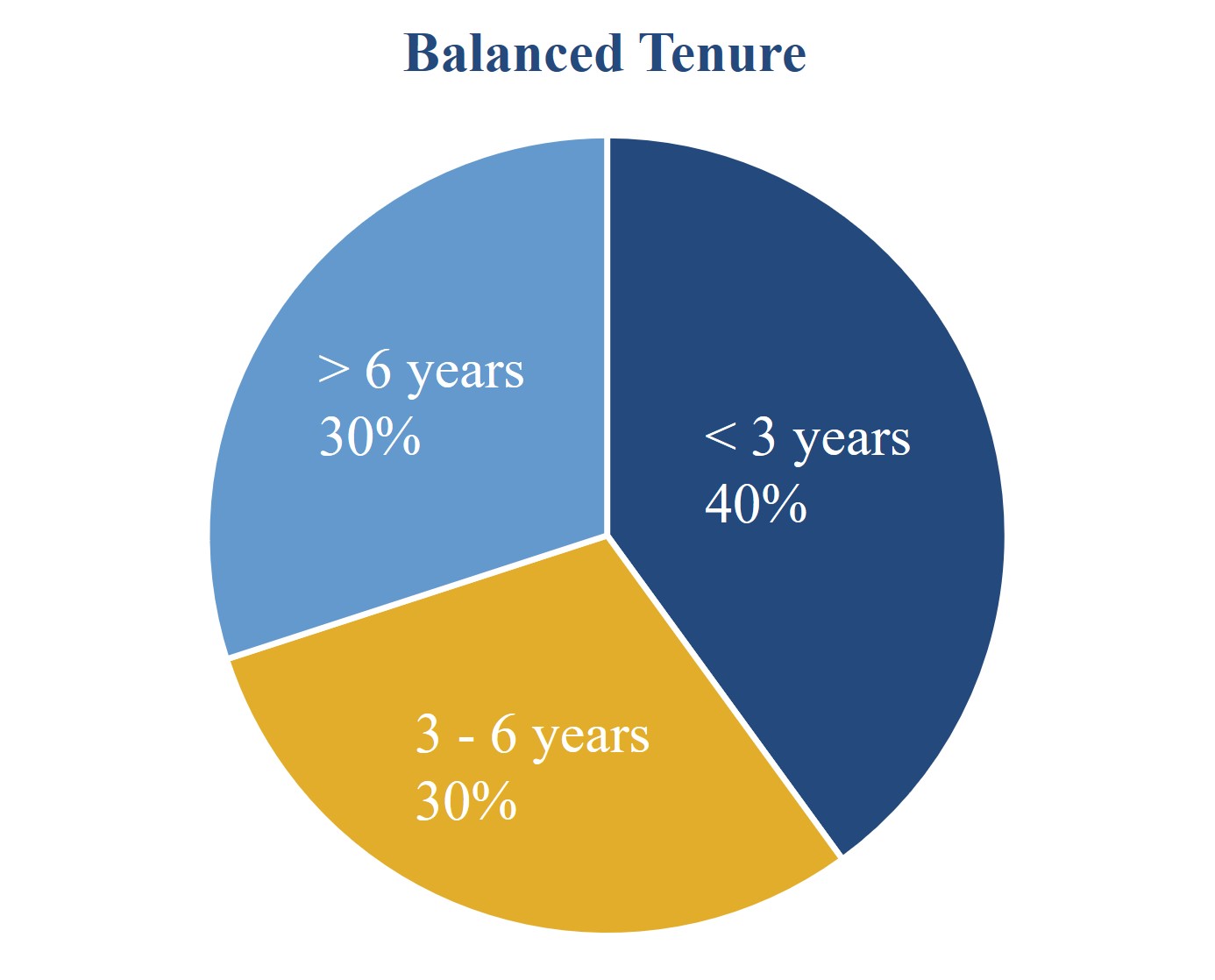

The Board maintains a robust refreshment process and remains focused on ensuring that the skills and experiences of the Board align with the Company’s evolving business. In the past four years, the Board has appointed six new members, all of whom brought different but relevant skills to our Board. The information in the table and graphs below describes the current composition of our Board and Board committees.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Directors | Faiz

Ahmad | Stephen Cutler | Allan Landon | Timothy Mayopoulos | John C. (Hans) Morris Independent Chairman | Kathryn Reimann | Scott Sanborn Chief Executive Officer | Erin Selleck | | Michael Zeisser |

| Age | 51 | 61 | 75 | 64 | 64 | 66 | 53 | 66 | | 58 |

| Director Since | 2022 | 2023 | 2021 | 2016 | 2013 | 2022 | 2016 | 2021 | | 2019 |

| Independent | a | a | a | a | a | a | | a | | a |

| Current Committee Membership |

| Audit | | a | Chair | | | a | | a | | |

| Compensation | a | | a | | | | | | | Chair |

| Credit Risk and Finance | | | a | a | Chair | | | a | | |

| Nominating and Corporate Governance | a | | | | a | | | | | Chair |

| Operational Risk | a | a | | Chair | | a | | a | | |

| Skills & Experience |

| Consumer Banking | | a | a | a | a | a | | a | | |

| Fintech | | | a | a | a | a | a | | | |

| Consumer Internet | a | | | | a | | a | | | a |

| Financial Markets | | a | a | a | a | | a | a | | a |

| Legal/Regulatory | | a | a | a | a | a | | a | | |

| Marketing/ PR | a | | | | | | a | | | |

| Compensation/ Employee Matters | | | a | | a | | a | | | a |

| Public Board Experience | | | a | a | a | | | a | | a |

| Risk Management | a | a | a | a | a | a | | a | | |

| Technology/ Product | a | | | | a | | a | | | a |

| Cybersecurity | a | | | | | | | a | | |

| | | | | | | | |

LENDINGCLUB CORPORATION| 5

|

| | | | | | | | |

2023 PROXY STATEMENT | PROXY SUMMARY |

Some of the statements in this Proxy Statement, including statements regarding financial results, our ability to effectuate and the effectiveness of Company strategy, the design of our compensation programs, the benefits of our products and services, Company performance, the dilution created by the Company’s equity compensation program and future equity utilization and the timeline for soliciting additional shares for issuance under our equity compensation program are “forward-looking statements.” The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “outlook,” “plan,” “predict,” “project,” “will,” “would” and similar expressions may identify forward-looking statements, although not all forward-looking statements contain these identifying words. Factors that could cause actual results to differ materially from those contemplated by these forward-looking statements include whether Proposal Six of this Proxy Statement is approved by the Company’s stockholders and those factors set forth in the section titled “Risk Factors” in our most recent Annual Report on Form 10-K, as filed with the SEC,Securities and Exchange Commission (the “SEC”), as well as in our subsequent filings made with the SEC. We may not actually achieve the plans, intentions or expectations disclosed in forward-looking statements, and you should not place undue reliance on forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in forward-looking statements. We do not assume any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

| | | | | | | | |

LENDINGCLUB CORPORATION | 65 |

| | | | | | | | |

20232024 PROXY STATEMENT | ENVIRONMENTAL, SOCIAL AND GOVERNANCE |

ENVIRONMENTAL, SOCIAL AND GOVERNANCE

| | |

Our mission is to empowerrelentlessly advantage our members by challenging the way banking is done. We provide smart, simple, and rewarding solutions that help our members achieve their financial goals. Since 2007, we have provided more than $90 billion in loans to over 4.8 million Club members, putting them on a path to betterpaying down their existing debt at a lower cost. Now, as a full-service bank, we’re intent on finding new value for our members across an array of financial health, giving them new ways to pay less on their debt and earn more on their savings. That is especially critical today, as economic volatility and the rising costs of food, gas, healthcare, housing, education, and more have contributed to millions of everyday Americans having insufficient financial reserves or living paycheck to paycheck, including almost 50% of those earning over $100,000 annually. We aim to offer lower cost solutions than traditional credit products to help them bridge cash flow gaps and manage their financial lives. Since 2007, over 4.5 million individuals have become members, joining the Club to help achieve their financial goals.products.

We believe that our business is inherently aligned with supporting Environmental, Social and Governance (“ESG”) matters. With oversight from our Nominating and Corporate Governance Committee, we intend to build upon our strategy, progress and disclosures on ESG matters over time based on stakeholder feedback and new rulemaking on the topic. |

| | |

| Our values are the foundation of what we strive to be, individually and collectively. They guide all aspects of our business, from strategic corporate decisions to promotions/hiring. |

Do What’s Right

We are committed to acting with honesty and integrity. We act in the best interest of our members and everyone involved. We recognize that trust and confidence are critical to our marketplace, so we stand up for what’s right — even when it’s hard.

Make Impossible Happen

We look beyond what is possible today to boldly imagine new and better ways to improve the lives of our members. We take on big challenges and drive relentlessly forward to overcome all obstacles to make our vision a reality.

Know Your Stuff

We are a data-driven business. Each of us must be an expert in our areas, continuously rooted in a deep understanding of the data. We measure our efforts so that we can manage, make well-informed decisions, and identify new opportunities.

Be Confident With Humility

We are exceptionally capable individuals who put our egos aside and focus on our collective goals. We listen first and assume positive intent. We get the right people together to inform our collective perspective, evaluate the implications, and debate the trade-offs — so we can move forward quickly, collaboratively, and with confidence.

Evolve With Purpose

We embrace and create change. While we set our strategy for the long term, we stay flexible to adapt to new opportunities. We test bold ideas in real-world situations, without the fear of failure, so we can improve and evolve.

Act Like An Owner

We take ownership and hold ourselves accountable to our commitments. We roll up our sleeves and pick up tasks that need doing, even if they’re not in our job description. We are committed to LendingClub’s future and we act that way.

| | | | | | | | |

LENDINGCLUB CORPORATION | 76 |

| | | | | | | | |

20232024 PROXY STATEMENT | ENVIRONMENTAL, SOCIAL AND GOVERNANCE |

| | | | | | |

| We aim to do our part in conserving the environment by incorporating environmental-related considerations and risks into certain aspects of our operations. Key actions we’ve taken to support the environment include: | | | | |

Light Physical Footprint

As a digital marketplace bank we operate online, which provides our members with access to banking services anywhere, anytime. This reduces the environmental impact associated with brick and mortar bank branches, including the impact of members visiting a bank branch.

Facilities

We lease LEED Gold certified buildings in San Francisco and Utah.Utah, which represent 87% of our total office space. When renovating our facilities, we emphasize recycling and the use of environmentally friendly materials.

Sustainability

We advocate for the use of sustainable or re-usable products in our spaces, such as providing compostable materials in our offices, and in our work, such as leveraging electronic signature platforms when possible.

Hybrid Work

We have adopted a hybrid work model for our employees, reducing the environmental impact associated with a fully in-office work environment, including the impact of our employees commuting to our offices each day and reduced office space needs.

Member Focused

Our core business is focused on relatively smaller denominatedsmaller-dollar loans to individuals and small businesses, and not dependent on large loans to customers that negatively impact the environment.environment (such as loans to companies in the fossil-fuel sector).

Efficient Data Centers

We utilize leading third-party data centers for data storage, that enableenabling us to remain environmentally efficient even as we grow our business, customer base, and data.data requirements.

| | | | | | | | |

LENDINGCLUB CORPORATION | 87 |

| | | | | | | | |

20232024 PROXY STATEMENT | ENVIRONMENTAL, SOCIAL AND GOVERNANCE |

| | |

LendingClub is a social impact business with a mission of empoweringadvantaging our members onand helping them achieve their path to better financial health.goals. We advance this mission through a technology enabledtechnology-enabled business model focused on the economic empowerment of Americans across the income spectrum, especially those that have not been well served by traditional banks.empowerment. |

| | |

| This aspiration, combined with our values, has driven us to lead the financial industry in advancing several policies and programs designed to reduce disparities, protect consumers and small businesses from irresponsible financing practices, and encourage innovation that supports financial health. |

| | |

| Championing Financial Health |

|

Through our digital marketplace bank, we help our members onachieve their path towards financial healthgoals by enabling them to pay less on their existing debt and earn more on their savings. By receiving a loan through LendingClub’s platform, many of our members take the first step toward financial health by refinancing out of higher cost debt. |

| | | | | | | | |

In fact, our borrowers have told us that approximatelyover 80% of personal loans receivedoriginated through LendingClub’s platform are used for refinancingto refinance or consolidatingconsolidate credit card debt. They alsoOur members have told us that wetaking out a LendingClub loan for debt consolidation improved their financial health, by reducing the APR on their debt by approximately fourfive percentage points on average and improving their credit score while providing a responsible paydown plan. We believe we are well positioned to increase our engagement with existing members by offering additional products and services to enable them to manage and improve their financial health.situation. | | LendingClub personal loans save borrowers in interest, while providing a responsible paydown plan to help borrowersthem regain control of their financial health. |

| | |

In order to champion the financial success of our members with fairness, simplicity and heart, weWe have also implemented a number of initiatives to support our borrowersmembers during difficult times. All of our members have a 15-day grace period to make loan payments with no penalty. We also launched a loan extension program, which extends the repayment term for eligible borrowers thatwho fell behind on their loan payments and have resumed making regular payments. The program allows such borrowers to become current on their loan and pay any past-due amounts at the end of the loan’s new repayment term, and helps borrowers that may have experienced temporary financial difficulty. Additionally, we offer relief programs to eligible borrowers to provide flexibility during tough timescrises, like natural disasters. DuringFor example, during COVID-19, we waived late fees for existing borrowers and launched new hardship plans tailored for the COVID-19 pandemic, which helped borrowers preserve their financial health in a difficult economic and credit environment. To support our small business borrowers,

We have also worked with external stakeholders to better understand the issues affecting consumer financial health. For example, from 2021 to 2023, we leveraged our digital banking capabilitiescollaborated with PYMNTS to supportprepare twenty-nine paycheck-to-paycheck reports. Through these reports, we sought to explore the Paycheck Protection Program (“PPP”). Throughoutpaycheck-to-paycheck landscape and provide a deep look into the pandemic, we cumulatively facilitated over $870 millioncore elements of PPP loans to help small businesses keep over 75,000 people employed.American consumers’ financial wellness, including their income, savings, debt and spending choices. |

| | | | | | | | |

| Competitive Interest Rates and Increased Savings | | |

| | |

Our technology is fundamental to our ability to deliver better rates and products. Over the past 1516 years, we’ve refined our advance credit decisioning and machine-learning models with more than 150 billion cells of data andderived from over $80$90 billion inof issued loans. With this underwriting technology, we’re able to underwrite loans more efficiently, which enables us to offer lower interest rates to our borrowers. | | Federal Reserve researchers found that LendingClub-facilitated loans maintain exceptionally low default rates while extending access to credit to riskier borrowers.credit. |

| | | | | | | | |

LENDINGCLUB CORPORATION| 8 |

| | | | | | | | |

| 2024 PROXY STATEMENT | ENVIRONMENTAL, SOCIAL AND GOVERNANCE |

| | | | | | | | |

On average, LendingClub members save ~$1,8002,200 over the term of a 36 month personal loan. | | Researchers from the Federal Reserve Bank of St. Louis found that LendingClub loans have had lower APRs than credit cards across FICO bands. Additionally, researchers from the Federal Reserve Bank of Philadelphia have found that “consumers pay smaller spreads on loans from LendingClub than from credit card borrowing”,borrowing,” which is supported by our data that indicates that our members save approximately $1,800$2,200 on average over the term of a 36 month personal loan from LendingClub. These savings also extend to our auto refinance loans, which reduce the APRs members pay by over three percentage points and results in average savings of approximately $2,100$2,500 over the life of the auto loan. |

| | | | | | | | |

LENDINGCLUB CORPORATION| 9

|

| | | | | | | | |

2023 PROXY STATEMENT | ENVIRONMENTAL, SOCIAL AND GOVERNANCE |

| | |

In addition to providing lower APRs, we have focused on being a responsible lender, and have voluntarily committedcommitting to a 36% APR cap on our loans. We have also supported legislation in California and Illinois to establish statewide 36% APR caps. Through our support of the American FinTech Council, we have also marshalmarshalled fintech support for federal 36% APR cap legislation. |

| | |

As a digital marketplace bank, we are also placing emphasis on helping our members build up savingsa financial cushion through products and services builtdesigned to help them make the mostkeep more of their money,what they earn, like our award winning high-yield savings and checking accounts. Through ourOur high-yield savings account members can earn one of the bestoffers a leading interest rates in the country on their account balance. There arerate with no monthly maintenance fees, fees to wire funds, or overdraft fees for our high-yield savings account, resulting in more savings and benefits for our members. With ourfees. Our checking accounts members can earnoffer interest at rates higher thanabove the national average, and unlimited cash back on qualified purchases with a checking account debit card. Members also save more using our checking accounts as we do not charge a fee for usingcard, free ATMs, we rebaterebates on ATM fees charged by other banks, and as there are no monthly maintenance, fees, overdraft, fees or incoming wire transfer fees. Our checking accounts have alsoproduct has earned official certification by the national Cities for Financial Empowerment Fund as meeting the BankOn National Standards for trust and affordability for consumer transactional accounts. Through these digital marketplace bank products and services, our members can effectively manage their cash flow and meet their financial goals. |

| | | | | | | | |

| Fighting Discrimination | | |

| | |

| We are committed to fighting discrimination in the financial services industry. For example, we were the first company to express support for “disparate impact” regulation when these anti-discrimination protections were under reconsideration by the federal government. Through comment letters to the Consumer Financial Protection Bureau (the “CFPB”), Federal Trade Commission and the U.S. Department of Housing and Urban Development, we articulated and advocated for the pro-innovation value of disparate impact regulation. We have also worked with the National Community Reinvestment Coalition on a consensus statement from civil rights organizations and fintech companies in support of strengthening these critical anti-discrimination protections. Further, we have supported disparate impact regulation in order to prevent algorithmic discrimination in lending to communities of color. | | “The value of disparate impact analysis was recently pointed out, and endorsed by, the largest personal loan company in the country, LendingClub, in its responses to requests for input by the CFPB.”

– Mike Calhoun, President of the Center for Responsible Lending, Senate Testimony 2019 |

| | |

Our loan products also help our members avoid discrimination in the financial services industry. For example, research by the National Consumer Law Center shows that when a consumer finances the purchase of a vehicle at a dealership, auto dealers are twice as likely to add markups to loans of Black borrowers than to White borrowers. Those markups are also routinely two-to-four times higher for Black people. Our auto refinance loans result in savings for all of our members, with our Black members seeing about 12% greater savings than White borrowers because those Black borrowers were more likely to be overcharged by their previous lender. |

| | | | | | | | |

LENDINGCLUB CORPORATION| 10

|

| | | | | | | | |

2023 PROXY STATEMENT | ENVIRONMENTAL, SOCIAL AND GOVERNANCE |

| | |

| Financial Inclusion |

|

We promote an inclusive financial system in whichwhere responsible innovation of products and practices cultivatesdelivers better financial health outcomes. We strive to lend to those underserved by traditional banks and our digital marketplace model allows us to fill credit gaps for consumers where bank branches may be less available, making for a financial system that is more accessible to all Americans. For example, our small business program with Accion Opportunity Fund has seen over 50% of its loans go to minority-owned businesses, as compared to less than 10% of loans by conventional small business lending banks. Further, researchersavailable. Researchers from the Federal Reserve Bank of Philadelphia have found that our credit model risk ratings have a low correlation with FICO scores while still effectively predicting credit risk at a high level of performance. This means that our digital credit models are able to identify consumers who would be overlooked or overpriced by traditional FICO-based models, providing more consumers with access to lower-priced credit. Additionally, a study by Federal Reserve researchers using LendingClub data found that fintech small business lending can create a more inclusive financial system by allowing small businesses that were less likely to receive credit from traditional lenders to access credit and do so at lower costs. |

|

| Researchers from the Federal Reserve Bank of Philadelphia have found that that “LendingClub’s consumer lending activities have penetrated areas that may be underserved by traditional banks, such as in highly concentrated markets and in areas that have fewer bank branches per capita.” |

| | | | | | | | |

LENDINGCLUB CORPORATION| 9 |

| | | | | | | | |

| 2024 PROXY STATEMENT | ENVIRONMENTAL, SOCIAL AND GOVERNANCE |

| | |

| We’ve also advocated for policies that encourage lending to minority-owned small businesses, such as urging the CFPB to implement Section 1071 of the Dodd-Frank Wall Street Reform and Consumer Protection Act, which requires lenders to report data on how they are serving minority- and women-owned firms. We believe that such policies will encourage innovation in lending, which may allow better inclusion of minority- and women-owned businesses by the financial services industry. |

|

| Helping Small Business |

|

We are focused on supporting small businesses. We’ve partnered with the nonprofit community development financial institution Accion Opportunity Fund to increase small business owners’ access to transparent, affordable,businesses and responsible credit. We believe that our small business lending activities have helped create or sustain over 100,000 jobs, in addition to helping the over 75,000 people that were able to remain employed with the over $870 million of PPP loans we facilitated during the pandemic. Further, a study from the Federal Reserve Bank of Philadelphia using LendingClub data found that fintech lenders, like LendingClub, “have been able to expand credit access to those underserved small business owners who are not likely to receive funding from traditional lenders…and in those areas that face a higher local unemployment rate.” |

| | |

Through our partnership with Accion Opportunity Fund, we have achieved 5xWe are focused on supporting small businesses and 4x the representation of minority-owned and women-owned businesses, respectively, inbelieve that our small business lending compared to conventional banks.activities have helped create or sustain over 100,000 jobs. |

| | |

| We also helped form the Responsible Business Lending Coalition to drive responsible practices in the small business lending sector. With the Responsible Business Lending Coalition, we co-wrote the Small Business Borrowers Bill of Rights, the first cross-sector consensus on responsible small business lending and the rights that small business owners deserve when obtaining a loan. Since its creation, the Small Business Borrowers Bill of Rights has been signed by over 110 nonprofits, community development financial institutions, fintechs and banks and has inspired a wave of small business protection laws across the U.S. |

| | |

| We believe that innovation in the financial services industry can lower prices for small businesses. However, in order for small business customers to identify and benefit from lower prices, they need to be able to easily compare the prices they are being offered. Accordingly, LendingClub and its coalition partners helped lead the passage of the nation’s first small business truth-in-lending law, California Senate Bill 1235, to help protect small businesses from irresponsible lending that disproportionately harms entrepreneurs of color. Similar legislation has since passed in New York and has been introduced in Connecticut, Maryland, New Jersey and North Carolina. Finally, we recently endorsed a bill introduced in the United States House and Senate that would extend the transparency standards of the federal Truth in Lending Act to small business financing. |

| | | | | | | | |

LENDINGCLUB CORPORATION| 11

|

| | | | | | | | |

2023 PROXY STATEMENT | ENVIRONMENTAL, SOCIAL AND GOVERNANCE |

| | |

| We are committed to sound and effective corporate governance practices. We have established a strong governance foundation through highly qualified directors, with strong oversight provided by our independent chairman. Further we have instituted significant stock ownership requirements for Board members and executives to promote strong alignment with stockholder interests. We also pursue robust stockholder engagement each year and have been responsive to stockholder feedback on key issues, including Board vote requirements, Board declassification, supermajority voting requirements and executive compensation programs. |

| | |

| We have also established key policies and guidelines that align with responsibly building value for our stockholders, including, among others, the following: |

| | | | | | | | |

LENDINGCLUB CORPORATION| 10 |

| | | | | | | | |

| 2024 PROXY STATEMENT | ENVIRONMENTAL, SOCIAL AND GOVERNANCE |

| | | | | | | | |

| Corporate Governance Guidelines | | Business Conduct and Ethics Policy |

| Our Corporate Governance Guidelines promote the effective functioning of our Board and its committees, promote the interests of our stockholders, ensure a common set of expectations as to how our Board, its committees, individual directors and management should perform their functions, and provide a flexible framework within which the Board may conduct its business. | | Our business conduct and ethics policy applies to all our directors, officers, employees and authorized third-party representatives and promotes certain actions, including honest and ethical conduct, compliance with laws, rules and regulations, the protection of LendingClub assets (including corporate opportunities and confidential information), and fair dealing practices, among others. |

| | |

| Officer Stock Ownership Guidelines | | Non-Employee Director Ownership Guidelines |

Under guidelines adopted by our Compensation Committee, our CEO should hold equity in LendingClub with a value of six times base salary, our CFO should hold equity with a value of three times base salary, and all other Section 16 officers should hold equity with a value of two times base salary. For additional information, see the section titled “Additional Governance Measures — Stock Ownership Guidelines” on page 40.38. | | Each non-employee director should hold an equity in LendingClub equal to at least $400,000 in value.value, which is 10x the base cash retainer for Board service. For additional information, see the section titled “Director Compensation — Director Stock Ownership Guidelines” on page 26.24. |

| | |

| Human Capital/ Diversity & Inclusion |

| | |

Our success depends, in large part, on our ability to recruit, develop, motivate and retain employees with the skills to execute our long-term strategy. We participate in a competitive market for talent and aim to distinguish ourselves by offering our employees the opportunity to make a meaningful positive impact on the financial health of Americans in an innovative technology-oriented environment. We also offer competitive compensation and benefits. Our compensation programs consist primarily of base salary, annual corporate bonus opportunity and long-term equity and cash awards. We are committed to providing equal pay for equal work. To support this, we regularly conduct pay equity surveys to ensure our compensation programs are applied equitably across our workforce and benchmark ourselves against industry best practices. Our benefits programs consist of comprehensive health, dental and welfare benefits, including a 401(k) matching program and standalone mental health coverage. We are committedalso provide employees with opportunities to support their communities by providing equal paydollar-for-dollar matching on qualified charitable donations up to $300 per year per eligible employee. Employees can also receive up to eight hours of paid time off for equal work. To support this, we’ve instituted pay equity assessments and benchmark ourselves against industry best practices.eligible volunteer activities. |

| | |

On January 12, In 2023, our total headcount decreased by 560 employees compared to the prior year, primarily due to the workforce reduction plans we announced a planimplemented during the year to streamline our operations and more closely align our expensecost structure to loan volume and revenue. The plan included a reduction of our workforce by 225 employees and a reorganization to align responsibilitiesfinancial profile given the continued adverse impact of the operation and utilization ofevolving macroeconomic environment on our investor marketplace and bank balance sheet (the “Workforce Reduction”).business. For employees impacted by the Workforce Reduction,a workforce reduction plan, we offered severance, extended benefits coverage and outplacement assistance. |

| | | | | | | | |

LENDINGCLUB CORPORATION | 1211 |

| | | | | | | | |

20232024 PROXY STATEMENT | ENVIRONMENTAL, SOCIAL AND GOVERNANCE |

| | | | | |

We strive to create a welcoming and empowering environment where our employees feel that they are reaching their full potential, are highly engaged and are doing what they do best every day to accomplish our mission and vision. We support our employees professionally through onboarding programs, on-the-job training, career development sessions and performance check-ins. We monitor employee satisfaction and engagement through semi-annual engagement surveys. The survey results provide an important measure of how employees experience our workplace, culture, priorities and values, and we use the survey results to make informed decisions about the LendingClub experience. During our most recent survey in the Fall of 2023, 91% of LendingClub employees responded. Our five highest rated categories were team camaraderie, accountability, manager, feedback and fair treatment. Our employee experience has earned a number of external recognitions, including being ranked #44 and #38 on Newsweek’s list of the top 100 most loved workplaces for 2022;2023 and 2022, respectively; being named one of the 2022 Best Workplaces in Financial Services & Insurance by Great Place to Work® and Fortune; Top Workplaces USA awards in 2022 and 2023; Top Workplaces awards for our Lehi, Utah office for every year in which we have operated an office there (2019, 2020, 2021, 2022)2022, 2023); Greater Bay Area Top Workplaces award for our San Francisco, California office in 2022; a score of 90 and a perfect score of 100 in the Human Rights Campaign Foundation’s 2023 and 2022 Corporate Equality Index;Index, respectively; and inclusion on Bloomberg’s Gender-Equality Index in 2022 and 2023. | Leading Workplace |

| #44 & #38 on Newsweek’s Top 100 Most Loved Workplaces in 2023 & 2022 |

|

| 2022 Best Workplaces in Financial Services & Insurance |

|

| Top USA Workplaces 2022 & 2023 |

|

Lehi, Utah Top Workplaces 2019, 2020, 2021, 2022 & 20222023 |

|

| Greater Bay Area Top Workplaces 2022 |

|

| Human Rights Campaign Foundation’s 2022 Corporate Equality Index |

|

| Bloomberg’s 2022 & 2023 Gender-Equality Index |

| | |

We have always been committedadhere, and expect all of our employees to advancingadhere, to our business conduct and ethics policy, which, among other things, sets forth numerous policies designed to provide for a safe, ethical, respectful and compliant work environment forenvironment. During the COVID-19 pandemic, our employees.commitment to our employees was guided by a core principle: keep our employees safe. With that principle in mind, in 2020, during the COVID-19 pandemic, we rapidly and effectively implemented a work from home program. In 2022, we reopened our physical offices while periodically calibrating our return to office strategy in public health guidance in combination with the needs of our employees.and have since adopted a hybrid work model. |

| | |

We continue to work hard to create a workplace that is welcoming and empowering for all. In addition to anti-racism, inclusive hiringWe have executive-sponsored leadership and breaking-bias trainingsmentorship programs for all of our employees, we have executive-sponsored programsincluding those designed to provide women and under-represented individuals with leadership tools and growth opportunities. Further, we have employee resource groups and an allyship program designed to empower ourall interested employees to advocate for the growth of minorities and build a more diverse and inclusive workplace. We have also established a program focused on supplier diversity to encourage contracts and partnerships with minority-owned businesses. |

| | |

| We are an equal opportunity employer and make employment decisions without regards to race, color, religion or religious creed, gender, gender identity, gender expression, transgender status, marital status, registered domestic partner status, age, national origin, ancestry, disability, medical condition, genetic characteristics, sexual orientation, natural hairstyles, military or veteran status or any other considerations made unlawful by applicable federal, state or local laws (“protected characteristics”). We also prohibit discrimination or harassment based on any protected characteristics or the perception that anyone has any of these protected characteristics, or is associated with someone who has or is perceived as having any of these protected characteristics. |

| | | | | | | | |

LENDINGCLUB CORPORATION | 1312 |

| | | | | | | | |

20232024 PROXY STATEMENT | ENVIRONMENTAL, SOCIAL AND GOVERNANCE |

| | | | | |

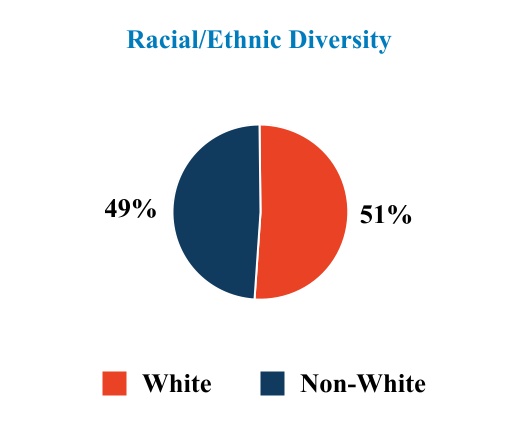

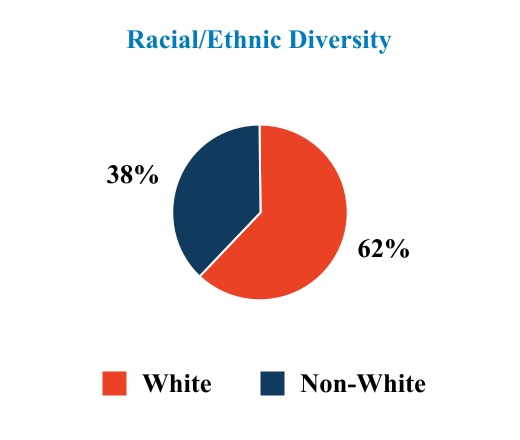

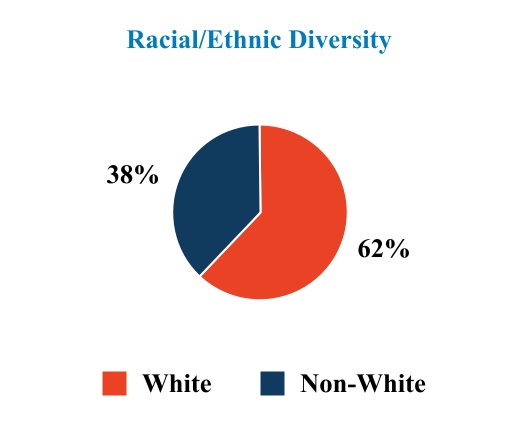

| We believe that having a diverse and inclusive workplace delivers better outcomes for our members and enables our employees to be their best. |

| | |

Diversity and inclusion are core to our corporate culture and we continue to strive to improve the diversity of talent within the financial services industry. We also treat diversity as an important consideration when making hiring decisions. We believe that the diversity of our employee base should represent the diversity of our customer base. For open roles at all levels of our workforce, including leadership positions (i.e., VP level and above), we aim for a 50% diverse candidate slate and diverse interview panel. We promote policies and regulations that prevent and/or address discrimination, including with respect to the use of artificial intelligence and fair and responsible lending to communities of color. Our efforts were recognized by Top Workplaces in 2022 as a Diversity, Equity and Inclusion Standout Company, reflecting our employee involvement, hiring processes, development practices and inclusive benefits. We intend to continue undertaking measures to enhance our efforts with respect to diversity and inclusion. |

| | |

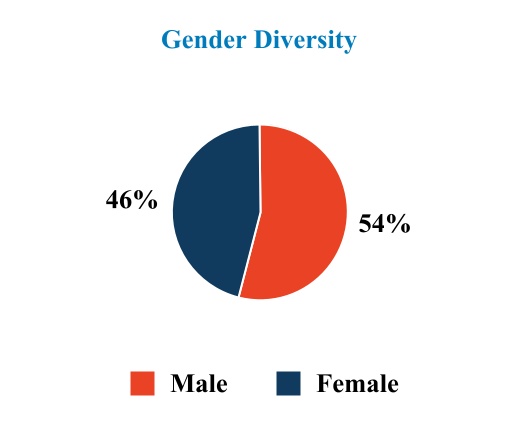

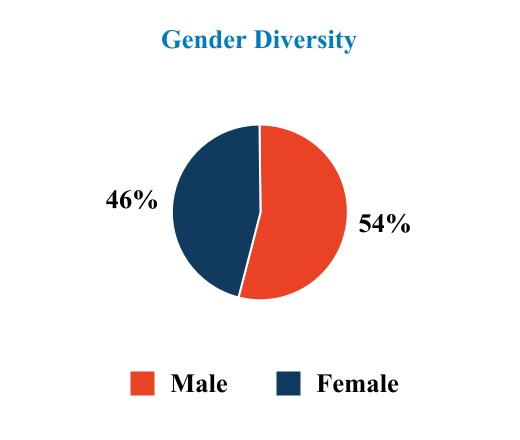

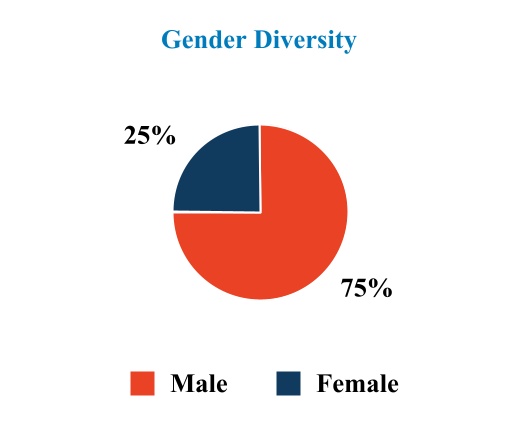

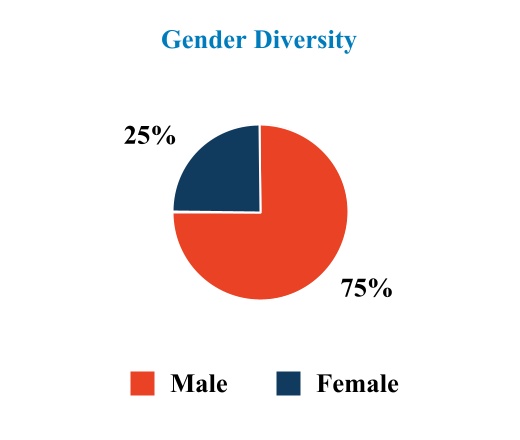

Below is a summary of certain demographic information of our full-time workforce as of December 31, 2022,2023, and specifically those employees that serve in leadership positions (i.e., VP level and above). |

Full-Time Workforce

Leadership Workforce

| | | | | | | | |

LENDINGCLUB CORPORATION | 1413 |

| | | | | | | | |

20232024 PROXY STATEMENT | BOARD OF DIRECTORS AND CORPORATE GOVERNANCE |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

LendingClub Board

Our Board oversees the strategy and overall business affairs of the Company. A key principle of our Company is maintaining the highest level of trust with customers, regulators, stockholders and employees. We have an active and engaged Board that is committed to fulfilling its fiduciary duties to our Company and stockholders, and helping us continue to earn the trust of our stakeholders. Currently all members of our Board also serve on the board of directors of our banking subsidiary, LendingClub Bank, and therefore are entrusted with monitoring and ensuring the safety and soundness of our banking operations as required by applicable banking regulations. Our Board is also responsible, in conjunction and consultation with the Compensation Committee, for periodically reviewing the performance of our CEO and for providing oversight of talent development and retention. Further, our Nominating and Corporate Governance Committee is responsible for providing primary oversight and review of our progress and disclosures with respect to Environmental, Social and Governance (“ESG”) matters.

Our Board currently has nineten members and may establish a different number of authorized directors from time to time by resolution. EightAll nine of our current non-employee directors are independent within the meaning of the listing standards of the New York Stock Exchange (“NYSE”). Our Board is currently divided into three staggered classes of directors. At each annual meeting of stockholders, a class of directors is elected for a three-year term to succeed the same class whose term is then expiring. Our Board has proposed to phase out the classified board structure subject to stockholder approval of Proposal Four of this Proxy Statement at the Annual Meeting. If that proposal passes, our Board will phase into a structure in which all directors will be up for election each year to serve a term ending at the next annual meeting of stockholders.

Our Class IIII directors standing for re-election, if elected, will continue to serve as directors until the 20262027 Annual Meeting of Stockholders and until his or her successor has been elected and qualified, or until his or her earlier death, resignation or removal.

Stockholder Outreach and Feedback

Our Board believes it is important to maintain an open dialogue with stockholders to understand their views on the Company, its strategy and its governance and compensation practices. Therefore, we engage with stockholders regularly and solicit feedback annually on our compensation and governance practices. Consistent with prior years, membersMembers of our management team participatedparticipate in these conversations, and stockholders wereare also offered the opportunity to speak with a member of our Board.

This outreach cycle, we filed stockholder outreach presentation materials with the SEC in January 2023. In early 2023 and early 2024, we actively reached out to stockholders representing, in aggregate, an estimated 50% and 46% of our then outstanding shares, respectively, and held meetings with those that requested a discussion, including with the governance departments of some of our largest institutional stockholders. Some stockholders declined our invitation for a discussion, citing a lack of questions or concerns. In total, since January 1, 2023 through our annual stockholder outreach, we have had conversations with stockholders holding, in aggregate, an estimated 42% of our outstanding shares. In addition to our annual stockholder outreach on governance and compensation practices, we maintain ongoing dialogue with many of our stockholders through our investor relations program. In total, since January 1, 2022,addition to our annual stockholder outreach on governance and compensation practices, we have had conversationsmaintain ongoing dialogue with stockholders holding, in aggregate, an estimated 46%many of our outstanding shares.stockholders through our investor relations program.

Overall, the stockholders we engaged with expressed support for our strategy and compensation and governance practices, including our efforts to declassify the Board and remove the supermajority voting standard. Stockholders further recognized the inherent social good of the Company’s business model and welcomed the Company’s disclosures on ESG matters. Certain stockholders inquired about the cadence of the Company’s review of its ESG disclosures and supported the Company’s commitmentSee “Proxy Summary – Responsiveness to incrementally evolve and enhance its ESG disclosures. Some stockholders also encouraged the Company to explore more leveraged compensation programs to further incentivize and reward management for outperformance scenarios, as well as explore diversifying the PBRSU program to include an ambitious, but attainable, multi-year operating metric to supplement the existing TSR metric.

Importantly, stockholders also generally expressed support for our proposal to amend and restate our 2014 Equity Incentive Plan, as well as our accompanying commitment to reduce dilution and adopt various best practices. In particular, stockholders noted that the proposal was thoughtful and appreciated the Company’s transparency and the self-awareness it reflected. With respect to dilution, stockholders recognized the significant steps the Company has taken to date and

| | | | | | | | |

LENDINGCLUB CORPORATION| 15

|

| | | | | | | | |

2023 PROXY STATEMENT | BOARD OF DIRECTORS AND CORPORATE GOVERNANCE |

welcomed the commitment to significantly reduce dilution from the Company’s compensation programs over time. Further, stockholders appreciated that equity compensation is a fundamental component of the Company’s ability to deliver market levels of compensation and that abruptly shifting to and increasing cash compensation to offset unavailability of equity compensation would be disadvantageous in the current economic climate and may also adversely impact the Company’s ability to attract and retain the human capital necessary to execute and advance its strategy. With respect to the timing of the proposal, stockholders recognized that the sooner the Company is provided more time to use its existing share reserve, the more expeditiously and systematically it can begin taking measures to reduce the dilution from its equity compensation program.

Finally, while some stockholders expressed a preference for an equity incentive plan that does not contain an evergreen feature, all stockholders we spoke with appreciated that the Company’s proposal does not include an extension of the evergreen feature and acknowledged that the Company is entitled to the final remaining evergreen tranche in 2024 per the terms of the existing equity incentive plan.

Further details regarding the proposed amendment and restatement of our 2014 Equity Incentive Plan can be found in Proposal Six of this Proxy Statement,Stockholder Feedback” beginning on page 70.2 for more information.

Board Leadership

John C. (Hans) Morris serves as the independent Chairman of our Board.

While our Corporate Governance Guidelines do not require the separation of offices of the Chairperson of the Board and the Chief Executive, the Board believes an independent Chairperson reinforces the independence of our Board as a whole and results in an effective balancing of responsibilities, experience and independent perspective that meets the current corporate governance needs and oversight responsibilities of our Board. We believe this structure provides consistent and effective oversight of our management and is currently optimal for us and our stockholders.

| | | | | | | | |

LENDINGCLUB CORPORATION| 14 |

| | | | | | | | |

| 2024 PROXY STATEMENT | BOARD OF DIRECTORS AND CORPORATE GOVERNANCE |

In selecting Mr. Morris as the independent Chairman, the Board considered his strong and relevant experience in financial services technology and the financial services industry, ability to provide effective leadership and facilitate open dialogue, and ability to devote sufficient time and attention to the position.

Board Role in Risk Oversight

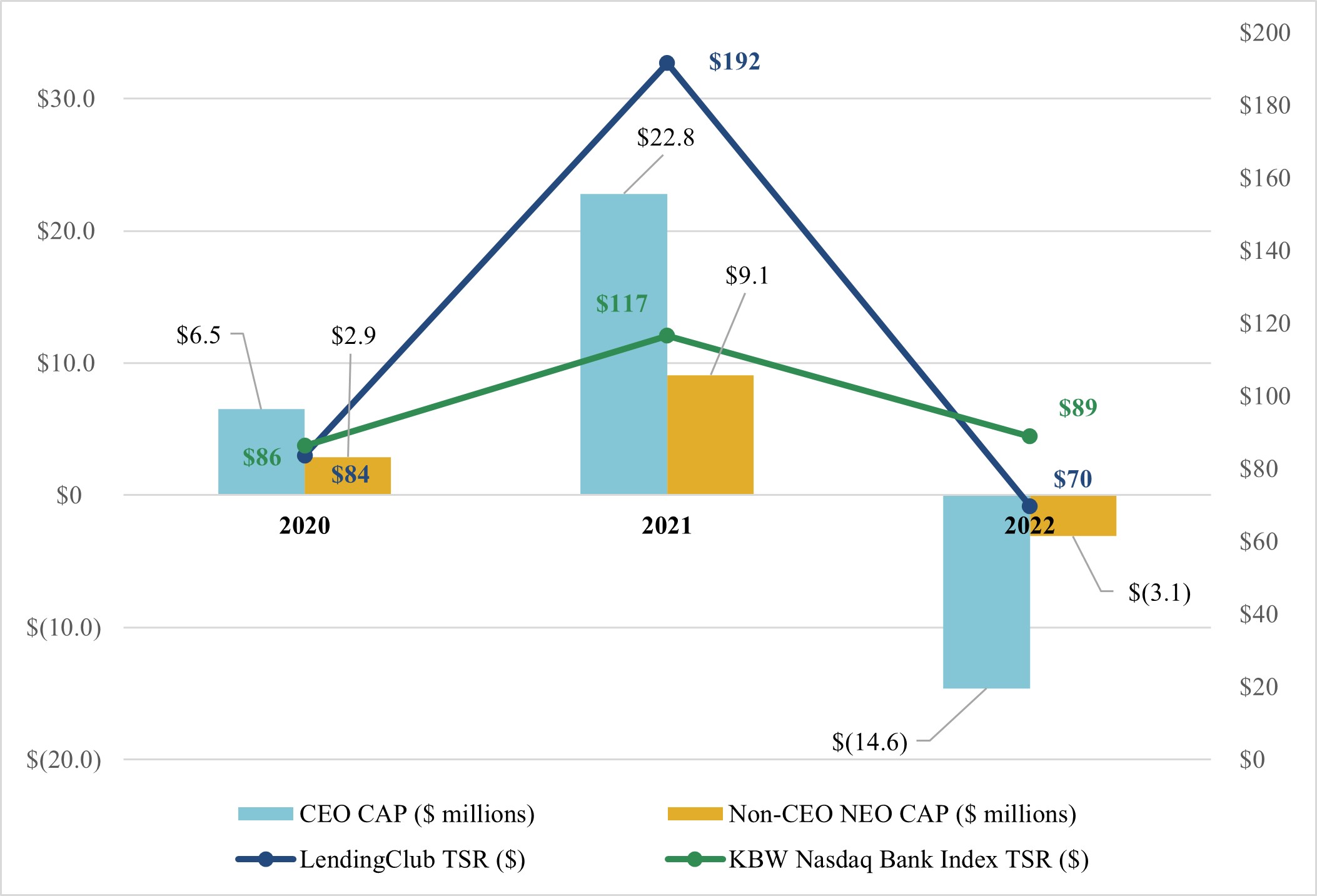

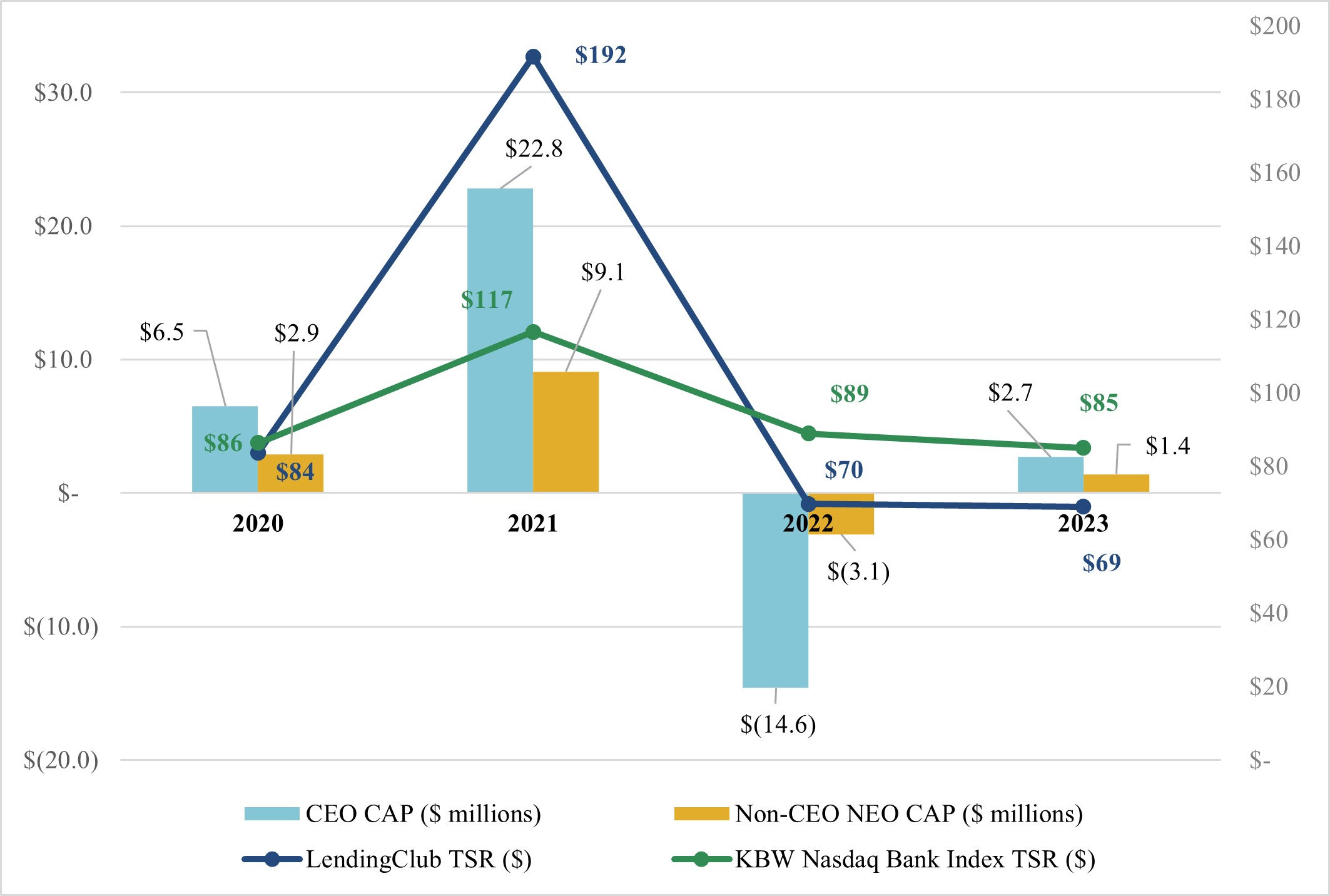

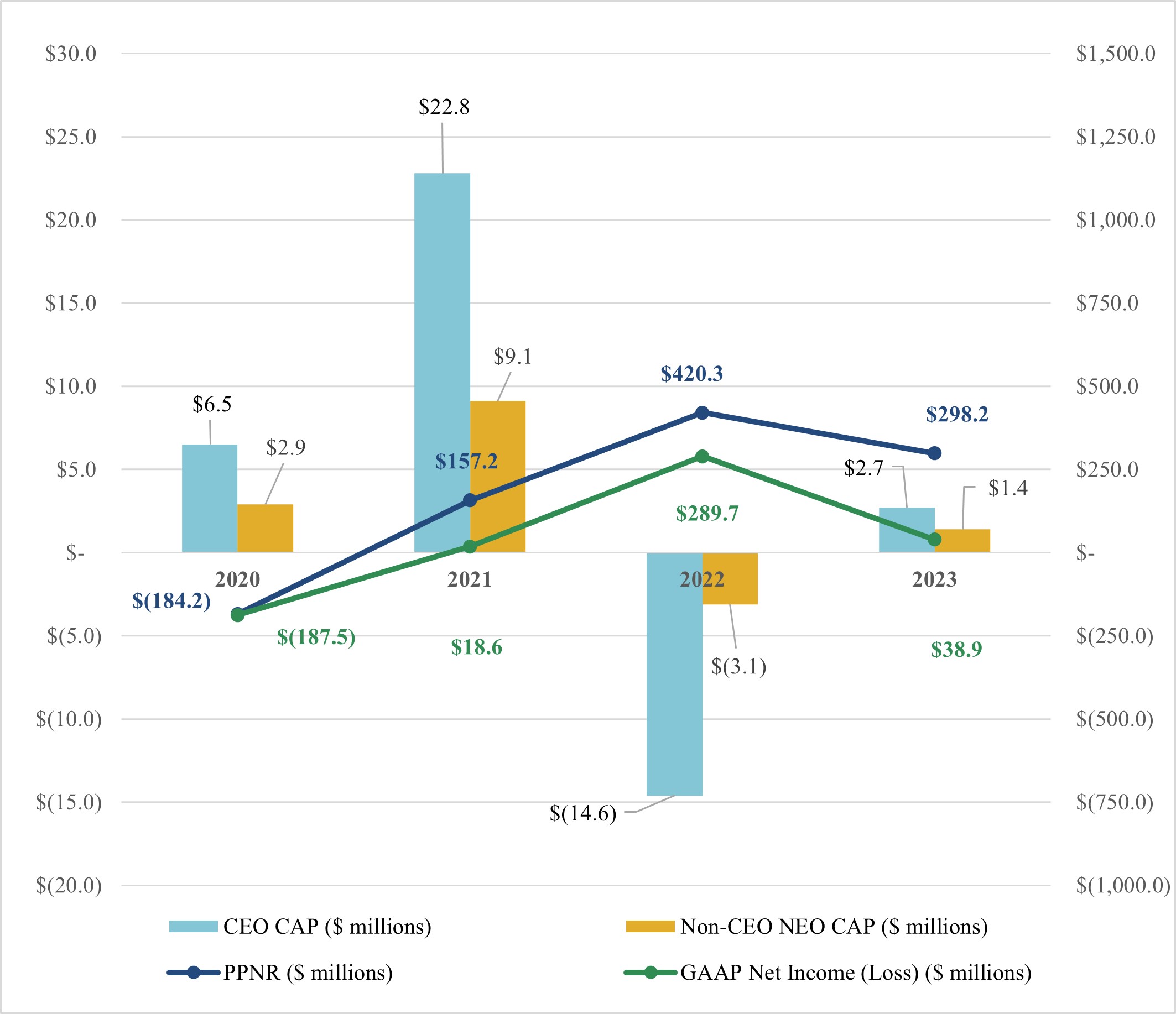

Management is responsible for assessing and managing risk, subject to Board oversight directly and through its committees. The oversight responsibility of the Board and its committees is informed by reports from our management team, including our Chief Risk Officer and an internal audit team, thatwhich are designed to provide visibility to the Board about the identification and assessment of key risks and our risk mitigation strategies. In addition, the Board has requested and has been receiving regular updates from management regarding our response to the recent changes in the macroeconomic environment (including increasing interest rates, elevated inflation and changing market dynamics) and their impacts on us and our customers, employees and other stakeholders, and our efforts to mitigate these impacts.